The ASX200 trod water last week with the rate-sensitive Tech & Healthcare Sectors being the best performers while the resources struggled as inflation fears gathered momentum e.g. Sandfire Resources (SFR) -6.7% and South32 (S32) -2.7%.

- No change, we believe this year will be about “buy weakness and sell strength” while stock & sector rotation will continue to provide plenty of excellent opportunities under the hood.

- Swings in economic optimism/pessimism are likely to drive this sector rotation e.g. as recession fears grow Tech & Healthcare are likely to outperform courtesy of declining yields.

Following another lacklustre session on Wall Street, the ASX is expected to nudge higher early this morning led by a 40c bounce by BHP Group (BHP) in the US.

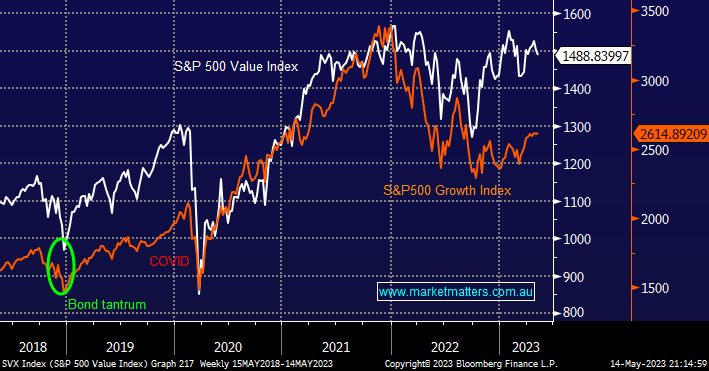

Recession fears continue to exert a huge influence over markets with bond yields targeting central bank pivots in the near future, year to date we’ve witnessed stocks that like a strong economy and higher rates struggle from a relative perspective e.g. Westpac (WBC) –9.7%, Woodside (WDS) -5% and BHP Group (BHP) -4.7% compared to Wisetech (WTC) +39.8%, Xero (XRO) +33.5%, and REA Group (REA) +25.5% i.e. 2023 has been dominated by growth stocks after the first 4 ½ months.

- No change, In the short term we can see further outperformance by the growth names as recession fears escalate but we are looking for opportunities to fade this move and increase our resources exposure, ideally at lower levels.

European stocks have now shrugged off hikes by both the ECB and BOE and they remain within striking distance of their post-GFC high i.e. as we often say markets that can ignore bad news are bullish. However in this case we wouldn’t be chasing such a breakout as the index continues to get dragged higher by a few large-cap names.

- No change, the EURO STOXX 50 looks set to test the 4500 area in the coming months i.e. only 5% away from Friday’s close.