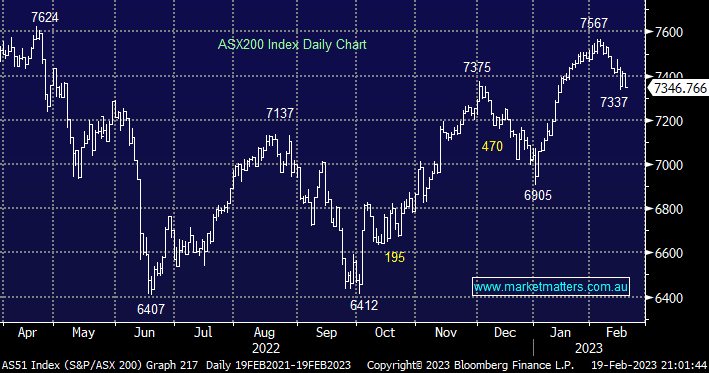

The ASX200 slipped -1.2% last week which was pretty impressive considering the carnage which unfolded across the Banking Sector following a softer underbelly to the result from Commonwealth Bank e.g. CBA -8.2% and NAB -5.8%. Reporting season will continue to dominate this week with large names such as APA, BHP, DMP, HUB, QAN, RIO, RHC and WOW stepping up to the plate – opportunities will undoubtedly likely be on offer.

- No change, we are still looking to slowly de-risk into strength although we remain buyers of decent dips on the stock/sector level.

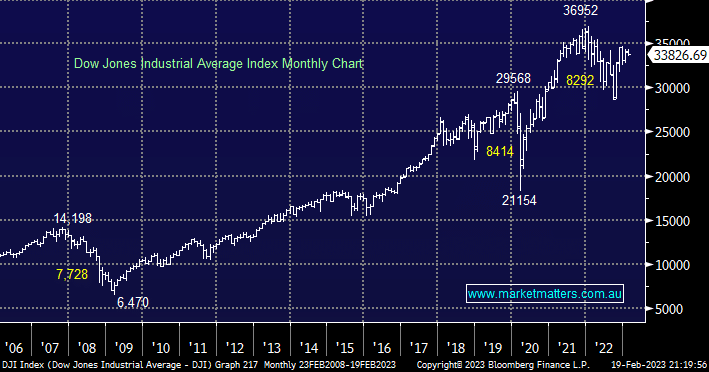

On Friday US stocks closed mixed with the Dow up +0.4% while the tech-based NASDAQ slipped -0.7%, all-time highs for growth stocks may remain a distant memory but it’s only ~8% away for the old stalwart the Dow.

- The Dow looks very capable of following the UK and French indices to fresh all-time highs in 2023.

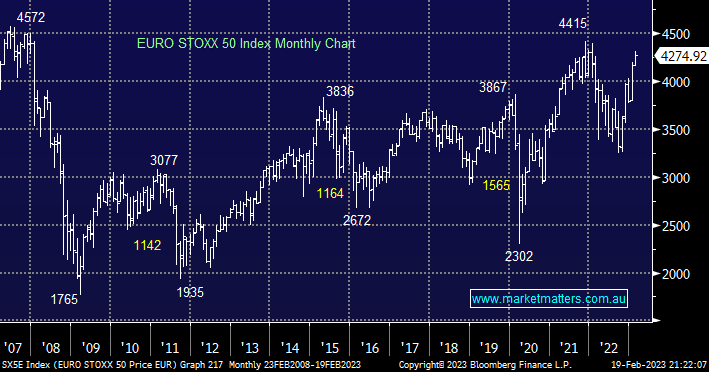

The EURO STOXX 50 is now only ~6% below its all-time high and while we aren’t keen buyers/chasers of the current strength a breakout to new highs feels almost inevitable which will test the numerous bears.

- With the UK FTSE and French CAC posting fresh all-time highs last week it’s hard not to be bullish at least to some degree.