The ASX200 surged higher last week with the resources leading the charge as the $US fell sharply e.g. Sandfire (SFR) +22%, BHP Group (BHP) +9%, Newcrest Mining (NCM) +14% and South32 (S32) +11%. The Tech Sector stood out from the crowd on Friday following the weak US CPI on Thursday, if we are correct the embattled growth stocks are about to play some performance catch-up after an awful 2022 to date.

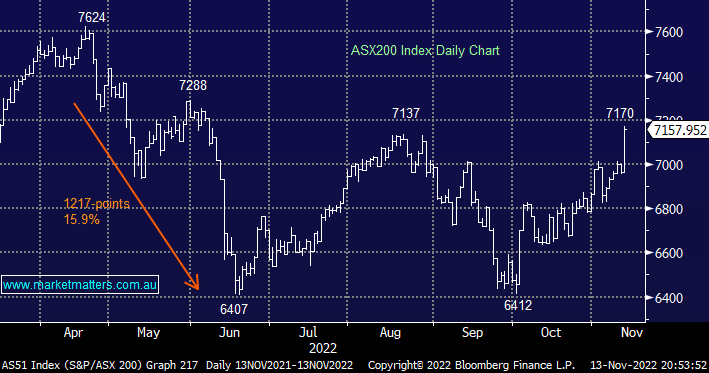

- No change, we still believe Australian equities are set to test 7200 into Christmas but surprises are more likely to be on the upside.

- After a terrible year we can see 1-2 months of outperformance from the growth/tech stocks.

However, the main question is clearly how far stocks are likely to rally before MM starts migrating down the risk curve, the answer to this question is we’re not sure. Stocks, which is so often the case, pre-empted the improving macro-economic backdrop and in today’s case, they will reach our minimum Christmas target before December although we have been running with the caveat that surprises are likely to be on the upside. Hence at this stage, we are being open-minded as to how far the ASX can push higher but we do expect the growth stocks to start helping with the heavy lifting.