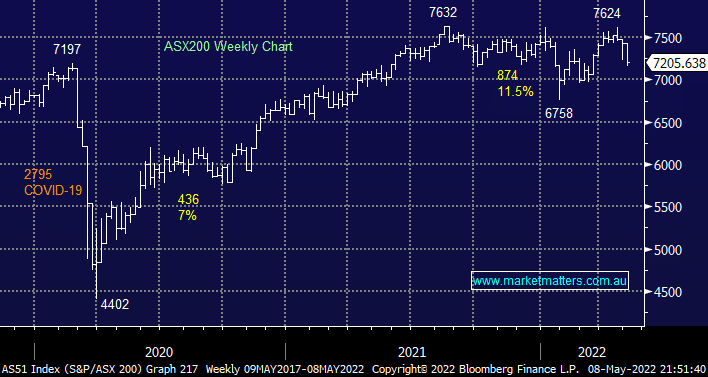

The ASX200 endured a tough start to May, as is so often the case, and this morning another 50-points looks set to be wiped off the index following a 5th consecutive down week on Wall Street. We cannot ignore the current warnings as the downside momentum gathers pace with US stocks now enduring their longest downside move in a decade, risk off continues unabated as central banks start hiking rates while money markets point to many more through 2022/23.

We feel like a test of 7000 is almost inevitable and technically we cannot reignite market optimism until the index closes back above 7250, and ideally 7300 – local stocks do feel a touch scary this morning which is at odds with an index less than 6% below its all-time high but the macro back drop is starting to weigh on all risk assets.