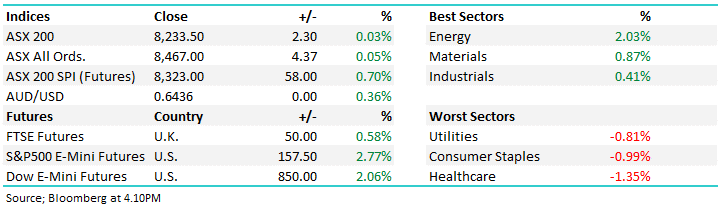

The ASX200 is set to dip back towards 6750 this morning, posting a fresh 12-month low in the process. We are still looking for a strong recovery through November/December, but as we said last week, “from where has become the million dollar question”. Considering the Middle East tensions, hawkish central banks, and ongoing market weakness, we now have to allocate a 50% possibility that the local index will test its 2-year support, i.e. back around the 6500 area, another 4% below Friday’s close.

- The SPI Futures are pointing to a -1% drop this morning, although BHP edging higher in the US should offer some support to the local index.

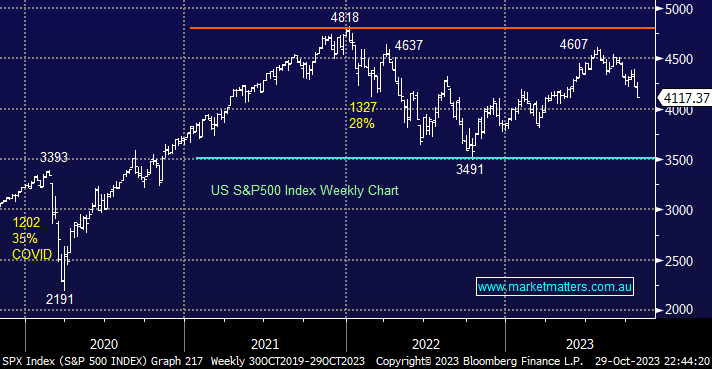

US stocks again slipped lower into the weekend, breaking below January’s high, which has forced us to adopt a neutral stance. Expanding on what we said last week, if we were traders, as opposed to Active investors, we would be sitting on the fence now, waiting to buy a break of back above 4250 in anticipation of a seasonal Christmas. This week will see another slew of influential US companies report, including McDonalds (MCD US), Caterpillar (CAT US), Apple Inc (AAPL US), Starbucks SBUX US) and Barrick Gold (GOLD US).

- In the medium term, we are now adopting a neutral stance as the S&P500 rotates in the middle of the last 2-year range – it’s going to be all about stock/sector selection until further notice.

European indices have followed the US lower, with the EURO STOXX 50 down over 10% from its August high, its pop towards 4500 is looking ominously like a false breakout. There are no clear risk/reward opportunities, with patience still looking to be the best game in town until further notice.

- The EURO STOXX has reached short-term support, although the bigger picture is starting to cloud as valuations get threatened by rising bond yields.