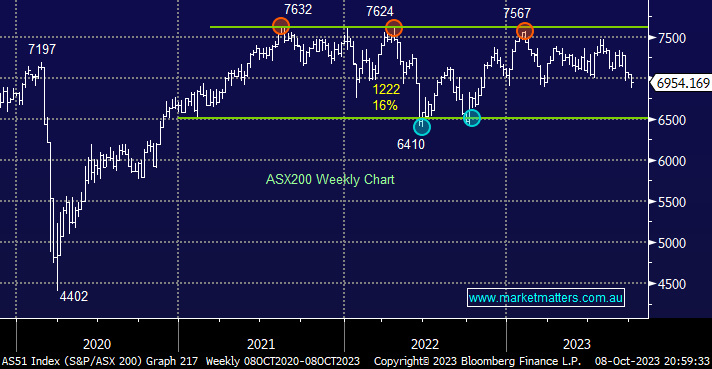

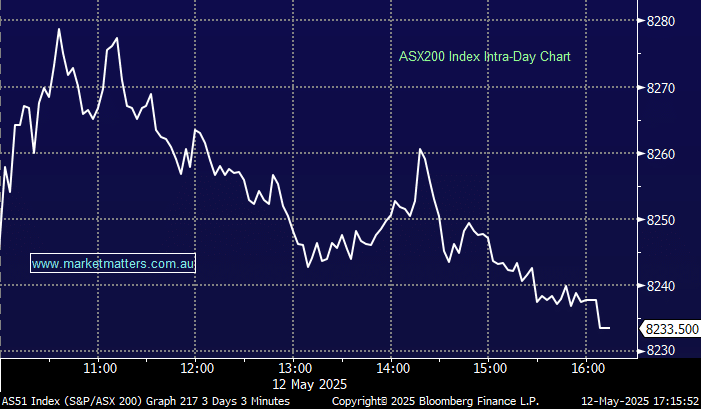

The ASX200 was set to pop back above 7000 this morning following a very impressive Friday session on Wall Street, which saw stocks shrug off a very strong non-farm payrolls number (employment data). Obviously, after the events over the weekend, it’s harder to predict what lays in store this morning, but we still believe stocks are looking for, or have found a low, and are set to rally into Christmas; hence, we are “buyers of dips as opposed to sellers of strength” until further notice.

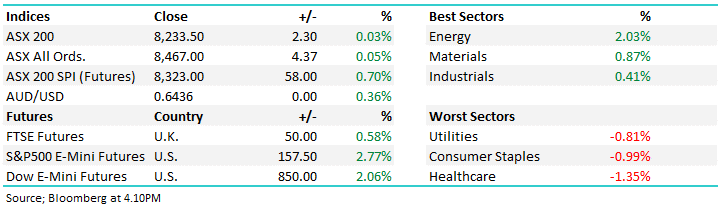

- The SPI Futures were pointing to a strong +0.8% gain this morning after gains across US indices, these could be tempered this morning.

The US Tech Sector led the impressive rally on Friday night, shrugging off interest rate implications of the huge beat by the US Employment data. If it weren’t for the news from Israel, we would be feeling very bullish towards US tech following last week’s gains. The short-term risks are now clearly elevated, but we would still buy dips in the sector this week.

- We remain bullish on the influential US tech stocks, ultimately targeting a break of the psychological 16,000 area for the NASDAQ 100 Index, around 7-9% higher.

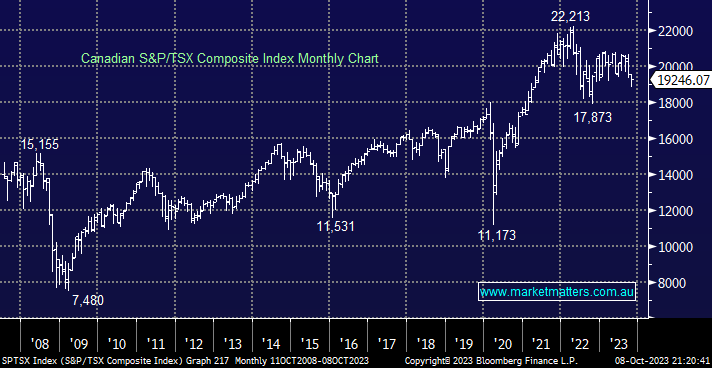

The Canadian TSX Composite Index is now up only +0.7% year-to-date, although it’s faring better than the ASX200, which is underperforming, sitting down -1.2% under the weight of heavy banking, real estate and large-cap resources stocks. From a technical perspective, we need to see a close by the index back above 19,750 to trigger buy signals, only around 3% higher.

- The Canadian Index, like our own, has struggled under the weight of recession fears and a subsequently heavy resources sector.