On Monday, CSL fell to levels not seen since April as an “if in doubt, stay out” attitude appeared to dominate the ASX healthcare giant – CSL is now down 5% year-to-date, compared to the ASX200, which is up +9.3% before dividends. Back in August, CSL’s FY25 guidance was ~4% shy of expectations, which, combined with the uncertainty now delivered by the Trump-Kennedy combination, is weighing on CSL, who manufacture flu vaccines. Historically, sales have been influenced by the “flu season”, but Kennedy’s anti-vax rhetoric is a concern.

For Seqirus, management recently noted a mild flu season in the US so far, although European uptake has been better supported. However, these normally closely watched factors could be irrelevant compared to Kennedy’s appointment.

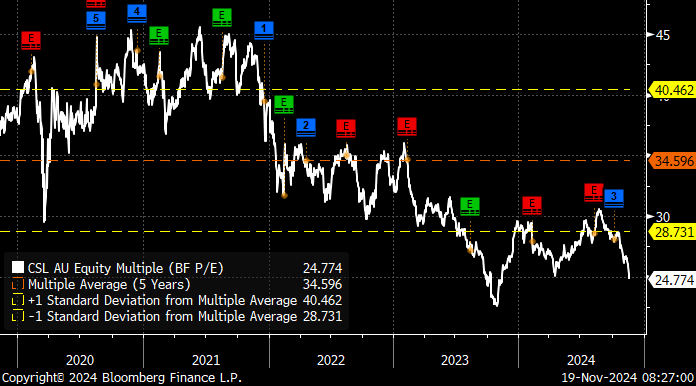

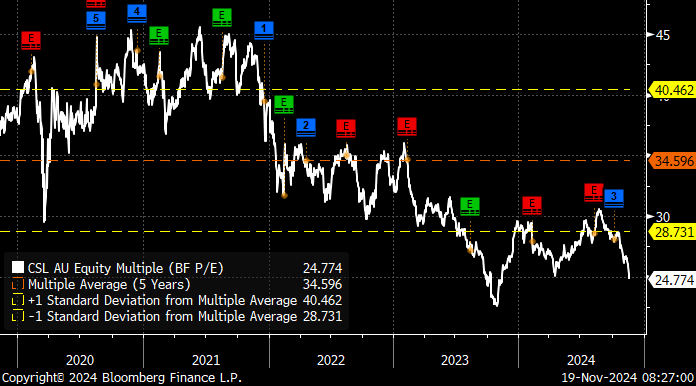

- In FY24, ~50% of CSL’s revenue came from the US, although we note the stock is one of the rare ASX majors trading on the cheap side compared to recent years.

- We are questioning whether our funds could be better deployed elsewhere as CSL continues to trade sideways – MM is long CSL in our Active Growth Portfolio.

With CSL trading on the “cheap” side, the big question is whether it’s cheap enough, given that the current uncertainty will likely persist well into 2025.