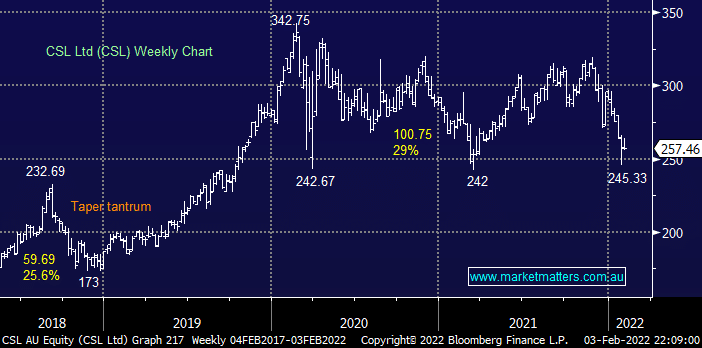

Blood plasma business CSL has followed the sell-off in growth stocks over recent weeks with the $6.3bn capital raise at $273 in December, to buy Swiss biotech giant Vifor Pharma, now down over 5%. The retail SPP component will be wrapped up by Monday and any further weakness as buyers are satisfied by the corporate activity should present good value medium-term. We have had a number of questions about the SPP which will be covered in tomorrows Q&A report, however ultimately we are unlikely to take up our shares.

Given the shares are below the raise price of $273, a calculation is applied based on a 2% discount to the average price of the stock for the 5 days leading up to the close of the offer. In this case, from the 1st Feb up to and including the 7th Feb. At this stage, and bearing in mind there are 2 days left to trade, the volume weighted average price of CSL is $259.85 subject to a 2% discount which equates to a price of $254.65.

While we like CSL, remaining long and bullish, we are comfortable with our current weighting, and there is not enough ‘fat’ in the deal for us at this stage.