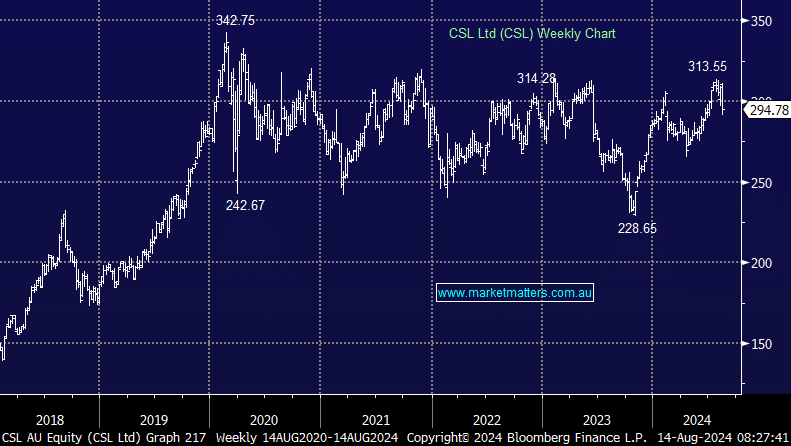

CSL is an Australian success story, with a market capitalisation of $142bn making up a significant 6.6% of the ASX200 (3rd behind CBA & BHP). Whatever way cut it, CSL is an important company for all Australian equity investors. Don’t hold CSL when it’s rallying and it’s hard to beat the index, but when CSL comes under pressure, having a low or no weighting will dramatically help relative returns. We know that relative returns are only one piece of the puzzle, but it is a concept that should be understood, providing a foundation to measure performance i.e. if we can do 2% above the index over 10 years, $1m goes to nearly $3m vs $2.45m (based on 9% annual index return).

Yesterday, the global biopharma company released FY24 results and guidance for FY25, the latter sending the shares nearly 5% lower. As a refresher, and following the acquisition of Vifor Pharma in 2022, CSL has three divisions: 1) CSL Behring (plasma derived products, recombinant proteins and other innovative therapies; 2) CSL Seqirus (vaccines); and 3) CSL Vifor (iron deficiency, nephrology and cardiorenal products). For FY24, all divisions delivered on expectations, driving an 11% increase in revenue to US$14.8bn and a 15% jump in net profit after tax before amortisation (NPATA) to $US2.91bn.

The driver of the growth was CSL Behring which is the plasma business and growth there is expected to continue – management saying “The momentum in our CSL Behring business is expected to continue to be underpinned by the strong patient demand in our immunoglobulins franchise”.

For FY25 though, the company guidance was ~4% below current consensus, with CSL tipping;

- Revenue growth to be approximately 5% to 7% over FY 2024 in constant currency.

- NPATA to be in the range of approximately US$3.2 billion to US$3.3 billion in constant currency. This represents growth of 10% to 13%.

While the outlook for Behring looks good, the outlook for Seqirus and the recently purchased Vifor look tougher. Pressure from generics in Europe is worse than thought while lower demand for flu vaccines is having a negative impact on Seqirus, though, CSL expect this to be a shorter-term issue.

CSL typically guides conservatively, and while the current guidance has underwhelmed the market, and will lead to consensus downgrades, we’re talking growth of ~13% (high end of guidance) vs growth of ~16% factored in. While CSL is not cheap in an absolute sense, trading on ~29x estimated FY25 earnings, it is on the cheaper side of history, usually commanding a multiple of ~34x.

- We intend to hold CSL, and would look to add to our 6% position in the Active Growth Portfolio if it pulled back below $280.