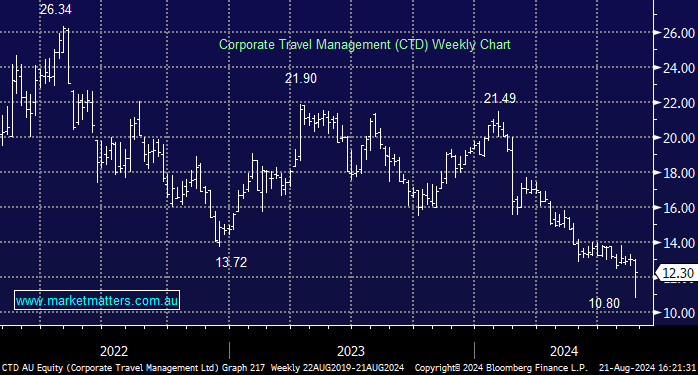

CTD -1.92%: was hit hard early, down ~10% on a weak result and downgraded FY25 guidance, however, by the close, they were only marginally lower. Reading the result first up looked like a big miss to both FY24 and guidance. We were not on the call today, so they’ve done a good job explaining away these results….

- FY24 revenue of $716.9m vs their own guidance of $730-760m and consensus of $743m

- Underlying Ebitda of $201.7m vs consensus of $213.8m.

- Underlying NPAT $113.3m vs $123.6m consensus

FY25 guidance for revenue growth of 10% also looks light on, plus it’s very skewed towards the 2H. Clearly we are not seeing what the rest of the market saw/heard, prompting a turnaround in the shares, however there was nothing in the result to turn us more positive.