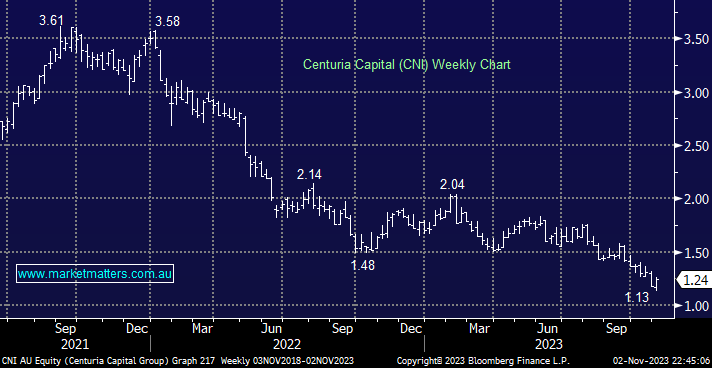

Property Fund Manager CNI has struggled in line with the underperforming sector since 2021, but it added to losses in August after it provided soft guidance and higher interest costs when it reported. CNI are one of the most leveraged ‘plays’ on interest rates given they have less interest rate hedging in place, a double edged sword that has clearly worked against them.

However, if bond yields/interest rates have indeed peaked, their FY24 guidance may prove conservative, allowing plenty of room for a snapback after such dire price action – plus, CNI is forecast to yield more than 9% plus some franking over the next 12 months, a good return if the stock just treads water.

- We are bullish on CNI, targeting up to ~25% upside over the coming months: we have held CNI in our Active Income & Emerging Companies portfolios since mid-2022, a tough journey so far.