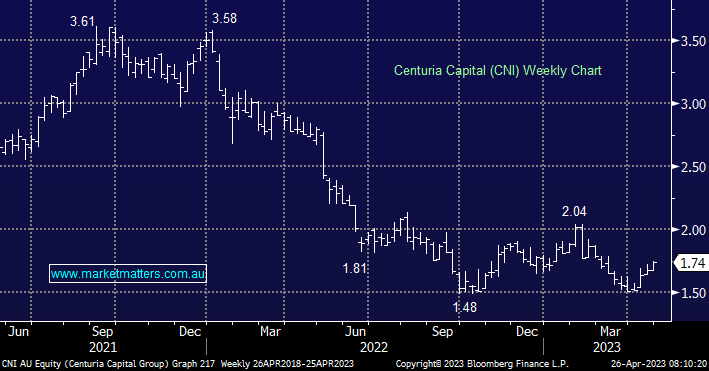

At MM, we’re always conscious of highlighting and discussing our weakest portfolio positions – if we look after those the rest will take care of themselves! Our weakest position in the Income Portfolio has been property company Centuria Capital (CNI) which is down ~12% , although it was off more a few weeks ago. Last week, Macquarie initiated coverage of CNI with a BUY equivalent rating and a $1.79 price target. Initiation reports are very in-depth, more so than a typical research piece with this one from Macquarie clocking 45 pages. Here are our thoughts, distilled down from the report.

- Historically, CNI has grown at a substantially higher rate than peers, and this drove outperformance v the sector, however, that outperformance has evaporated and they are ‘back to the pack’ now, trading at a discount to peers.

- Industrial and Office have been the main exposures for CNI over time, however, they now have a focus on scaling up on core sub-sectors of Agriculture, Healthcare & Real-Estate credit, for instance, last year CNI bought a 20-hectare glasshouse facility used to grow Truss Tomatoes, including its own desalination plant.

- These areas will improve diversification and drive growth over the coming years, and while their co-investment model creates more volatility in returns, we like the approach of backing their own products/funds.

- A key risk worth highlighting for CNI is gearing and low-interest rate hedging, which makes it a higher-risk proposition in MM’s view.