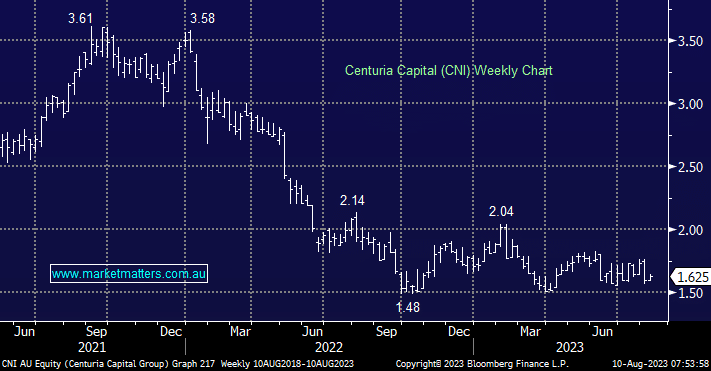

Centuria Capital (CNI) has struggled over the past 12 months but the Industrial real estate manager should in theory be a significant beneficiary of falling bond yields as they carry a fairly low level of hedging, but the sector generally has been under pressure as valuation write-downs come through thick and fast, creating headlines and influencing sentiment along the way. It is our opinion that declines in asset values have already been factored into CNI around current levels, and their large holdings in Centuria Office REIT (COF) and Centuria Industrial REIT (CIP) could support performance after detracting from it over the past 12 months – as an added bonus CNI is currently forecast to yield 7.2% over the next 12 months.

- We are considering CNI for our Flagship Growth Portfolio into current sector weakness.