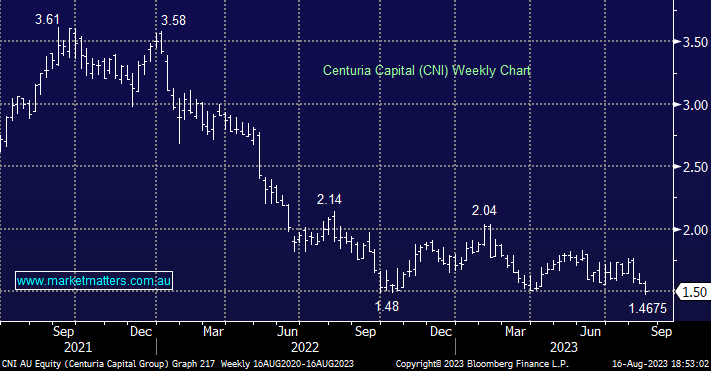

We continue to like CNI but importantly its testing excellent risk/reward levels, there’s no change in our view except the price is making the stock more attractive as a potential addition to our Flagship Growth Portfolio. The Industrial real estate manager should benefit if/when bond yields fall but the sector remains under pressure as valuation write-downs come through, we saw a few yesterday! In our opinion the declines in asset values have more than been factored into CNI, around current levels, however, they do have a large holding in Centuria Office REIT (COF) that reports today while CNI itself is set to report tomorrow. – these could turn the dial.

- We continue to like the idea of accumulating depressed property stocks, trading at steep discounts that have strong yields.