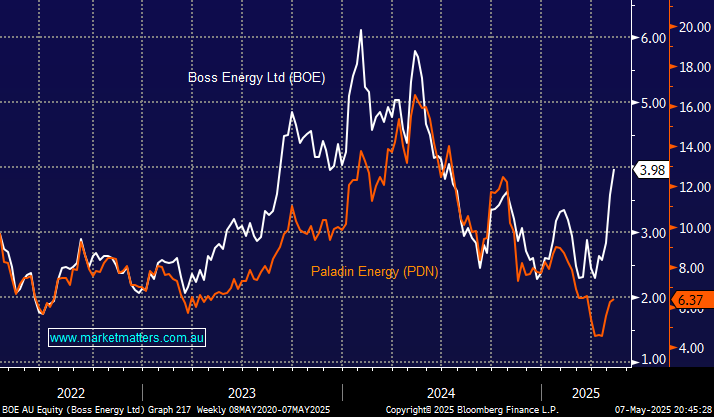

As subscribers know, we remain bullish on the uranium thematic, but it’s been a painful journey for most of the sector in 2025, except BOE, which has bounced strongly. The outperformance of its peers was compounded last week after BOE delivered a strong quarter, which felt like it squeezed the massive +25% short position in the uranium miner. However, PDN isn’t too far behind with a +15% short position of its own. We can see PDN beating expectations and producing ~2.8 million lbs of uranium in FY25. With the stock “priced to miss”, this could create a similar short squeeze of its own. We believe the market has over-reacted to short term commissioning issues at is Langer Heinrich mine in Namibia.

- We believe PDN will play some “performance catch-up” over the coming months: We hold PDN in our Emerging Companies and Active Growth Portfolios.