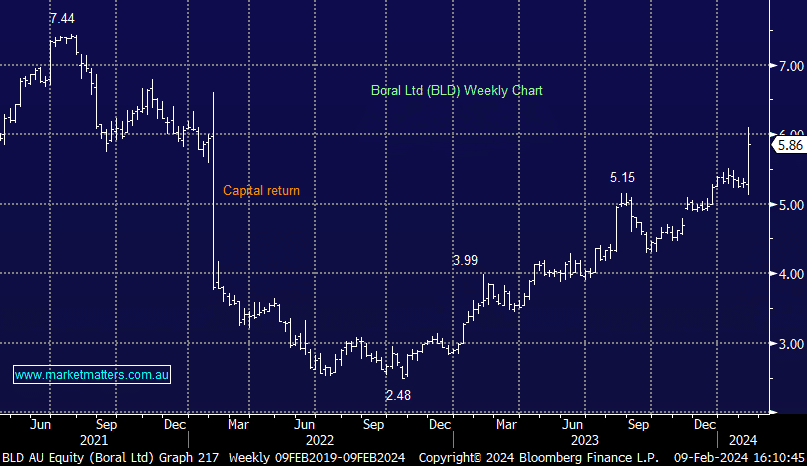

BLD +8.32%: the building products company beat expectations, surging to long-term highs on a strong 1H result. Revenue was in line, however, EBIT was a strong ~25% beat to expectations, up 111% to $201m. While cost control was solid (SG&A +3% vs revenue +9%), the bulk of the beat came down to stronger than forecasted margins out of the quarry business while the other segments of their operation were broadly in line or a miss. Despite upgrading guidance for FY24 (EBIT guidance +4% vs previous expectations), the company is effectively guiding to a 2H miss given the strong 1H numbers announced today.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

MM is neutral BLD, having missed the boat for now

Add To Hit List

Related Q&A

Thoughts on Boral (BLD)

How / when will Boral BLD return of capital to investors?

Boral & Magellan under the microscope

Boral (BLD) – why is it falling?

Q’s on CSR, BLD, TAH, HLS

MM tackles BLD, HLS, CSR

Relevant suggested news and content from the site

Video

WATCH

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Recorded Friday 20th February 2026

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.