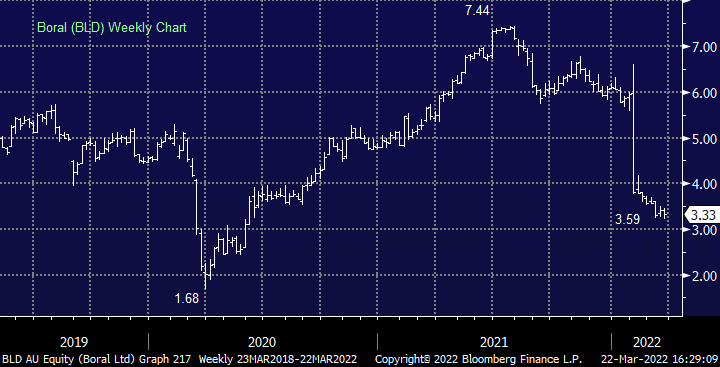

BLD -3.48%: provided FY22 guidance for the first time today which disappointed. EBIT is expected to come in between $145-155m for continuing operations for the full year, down from $181m last year. The severe weather events across Australia’s east coast is expected to have a ~$23m impact on earnings with lower volumes. Higher coal and diesel prices are also biting. They currently have no hedging in place for their coal exposure, and they are only covered through to the end of April for diesel. Higher fuel prices will also cause more havoc on already constrained supply chains, likely further impacting the FY22 result.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

MM is neutral BLD at best around $3.30, with a preference for CSR

Add To Hit List

Related Q&A

Thoughts on Boral (BLD)

How / when will Boral BLD return of capital to investors?

Boral & Magellan under the microscope

Boral (BLD) – why is it falling?

Q’s on CSR, BLD, TAH, HLS

MM tackles BLD, HLS, CSR

Relevant suggested news and content from the site

Video

WATCH

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Recorded Friday 20th February 2026

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.