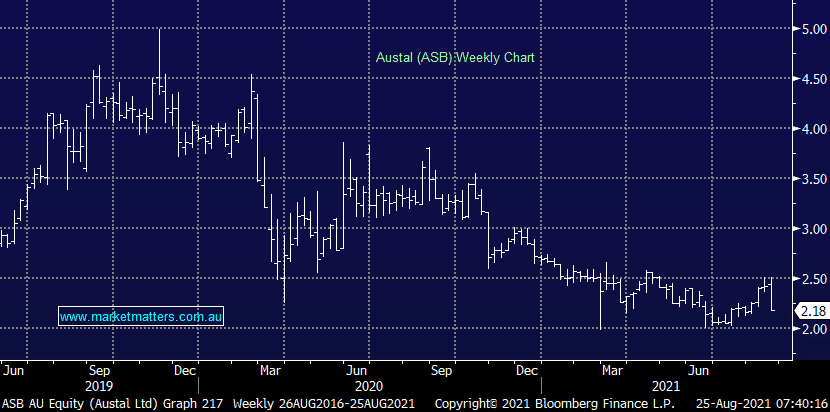

We spoke to management yesterday following their FY21 results. On first read it looked a solid / inline result with revenue and EBIT hitting estimates. A few things to note – guidance for flat revenue was as expected, though they used the assumption of 75c for the AUD. On current levels, that’s about a 6% downgrade. The order book needs some work (FY23 and beyond), however they are in a good position to win contracts this half plus they have a solid balance sheet. They are looking to offload a stake in a Chinese JV, I suspect this will be a catalyst for the stock.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

Monthly Update: Portfolio performance and positioning during October

Monthly Update: Portfolio performance and positioning during October

Close

Close

MM remain positive ASB despite the market reaction to their result

Add To Hit List

Related Q&A

Q&A for Sat Weekend report – ASB & XRO

Thoughts towards Austal (ASB)

Thoughts on ASB after its downgrade?

Thoughts on Capitol Health, Austal and Standline Resources?

Austal (ASB) – is it a buy?

Is Austal a takeover target?

Austal (ASB) share price decline

Relevant suggested news and content from the site

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Recorded Thursday 20th November

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Video

WATCH

Monthly Update: Portfolio performance and positioning during October

Recorded Thursday 6th November

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.