Hi Debbie,

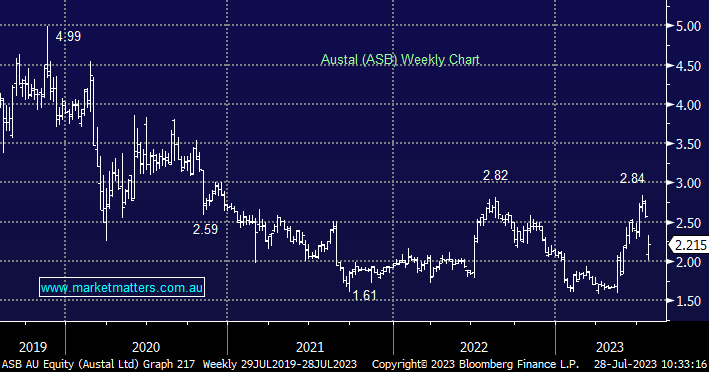

It has been a consistent theme of Austal over the years with optimism from big contract wins helping fuel a rally before cost pressure comes in and downgrades come through. The latest downgrade from the company was significant cutting EBIT expectations by ~$60m and now expecting to post a loss when they announce results next month. Half of the downgrade was as a result of slower realization of efficiencies at the new steel manufacturing site, likely to weigh on earnings in FY24 as well.

The other part of the downgrade stemmed from contract amendments to towing and rescue vessels. The company has been disputing the amendments and we would expect revised terms to benefit Austal which is likely to offset some of the current pain with greater earnings in FY24, though there is risk around this.

M&A rumours around a takeover of ASB have been swirling for some time. We see a 50/50 chance of a bid coming though it is unlikely to attract the same premium that a bid for other stocks might given the regulatory risk posed to a buyer, and the smaller pool of potential bidders. A number of signatures would be required to get a deal over the line including the US Navy so it would likely only come from an established Defence contractor.