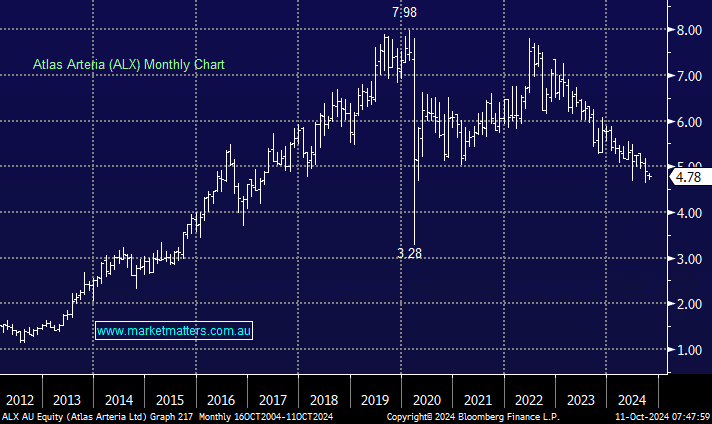

The owner of toll roads in France, Germany & the US has been struggling since interest rates started to increase in 2022, though budgetary pressures in France which is creating uncertainty around tax policy is also to blame, sending the shares down by more than -17% year-to-date. Operationally, their performance has started to improve across their network, however, with France running a budget deficit of 5.5%, above the 3% EU limits, higher taxes is certainly a possibility.

While there are no triggers yet to chase ALX, some certainty in France would be a positive, and of course, corporate interest from IFM remains in play. For now a yield of more than 8% is compensating investors for patience.

- We can see ourselves considering ALX in 2025, with dividends likely to grow from 2027.