The ASX200 closed marginally lower yesterday after sentiment was dimmed by a disappointing close from US stocks and negative news/rumours of weaker demand from Chinese cathode producers pummelled the lithium stocks – it didn’t help as we’ve touched on earlier that the market was caught very long ESG names. Time will tell if the rumours prove correct but we believe the sector has already witnessed its best prices for 2022.

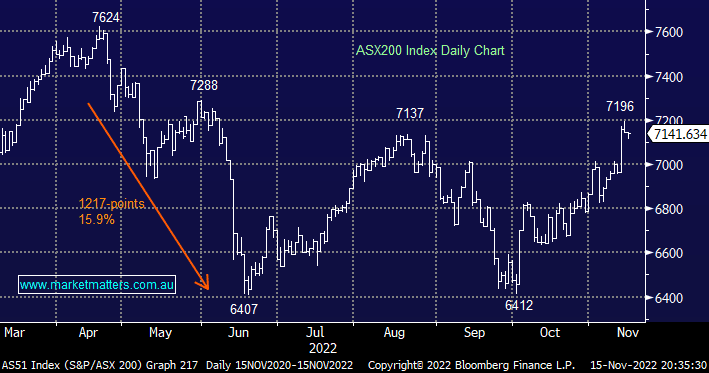

- after testing the psychological 7200 area we believe it’s time to go back to basics and “buy weakness and sell strength”.

- With MM fully committed to stocks and the index having reached our initial target for a Christmas rally by definition we are now in “sell mode”.

The SPI Futures are pointing to another small dip this morning as anticipated gains in the tech stocks are likely to be overshadowed by further selling in some resource’s names – another night when the local futures followed the European stocks as opposed to the US which was led higher by a +1.45% rally by the tech-based NASDAQ.