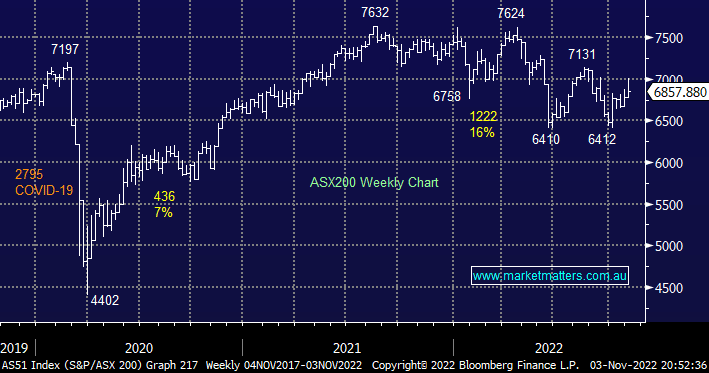

Following yesterday’s conclusive rejection of the 7000 area, albeit under the influence of the US Fed our preferred scenario is local equities now spend a few weeks regaining their breath before attempting another foray on the upside but we shouldn’t forget that until further notice we regard this as a bear market rally and as such MM is likely to de-risk into such strength, ideally in the 7200 area but obviously all stocks will be evaluated individually.

US equities experienced a choppy session overnight while UK stocks rallied even after the BOE hiked 0.75%, their largest move in over 30 years, plus they flagged the longest recession was coming since 1955 i.e. there’s plenty of bad news already baked into this particular cake. The S&P500 ultimately closed down -1.1% and the SPI Futures are pointing to a -0.35% drop early this morning.

- MM still believes the ASX200 is set to test the 7200 area into Christmas with any surprises still likely to be on the upside.