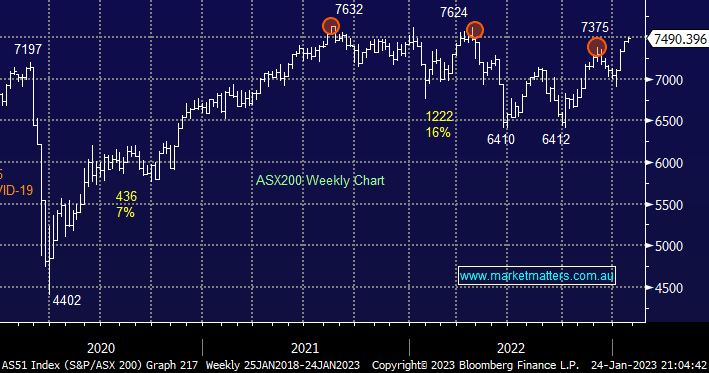

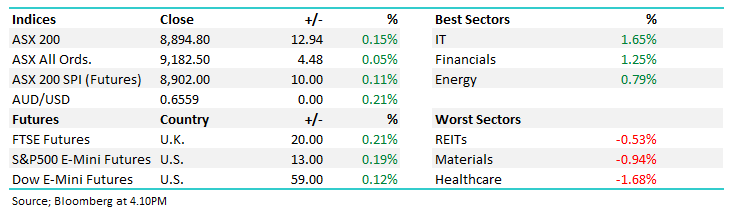

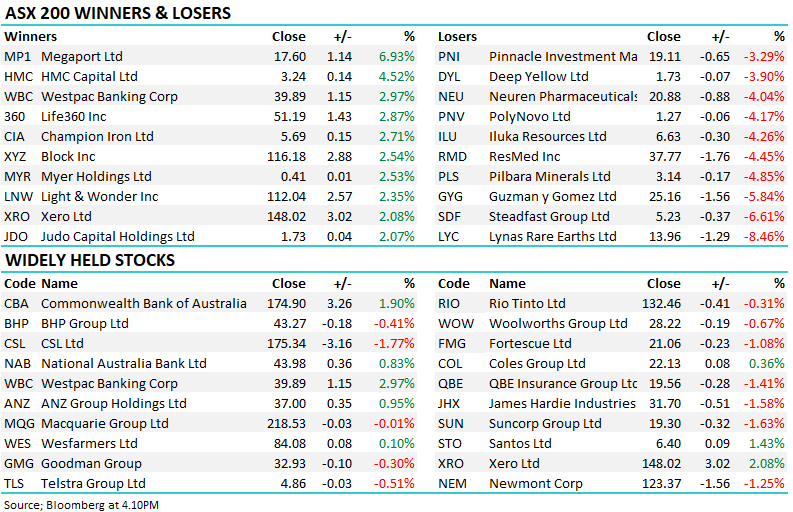

The ASX200 ended up another +0.44% yesterday taking the month’s gain to 6.4% leaving the index less than 2% below its all-time high. Gains were reasonably broad-based on Tuesday with 66% of the main board advancing led by tech, real estate, and resources plus a return to favour of the ESG names. The local index is enjoying its 2nd best start to a year in 30 years as investors believe local inflation will fall short of the RBA’s 8% forecast e.g. well respected Westpac economist Bill Evans tipped today’s inflation data will show a peak of 7.4%.

- We continue to believe selling strength and buying weakness will pay dividends through 2023 suggesting this is not a great time to be buying local stocks.

NB another 0.3% advance by the ASX200 into month end and it will have beaten 2020’s post-Covid recovery to become the best year in three decades.