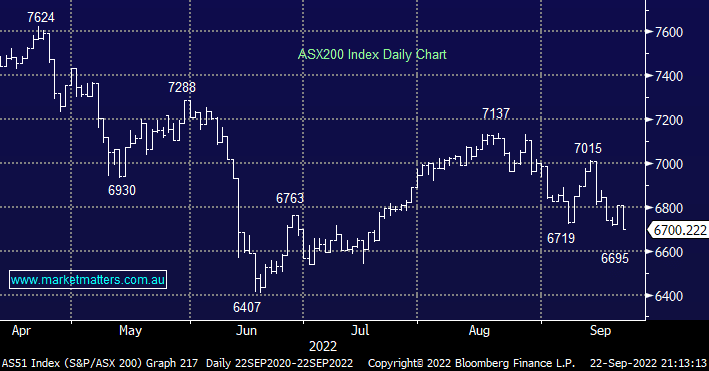

The ASX200 was smacked over 100-points on Wednesday as nobody wanted to go home long ahead of a 2-day break which included the FOMC meeting. We feel this uncertainty means the vast majority of any potential buying which may hit the market from the $18bn tsunami of recent dividends from the likes of BHP Group (BHP), RIO Tinto (RIO) and Telstra (TLS) is still waiting on the sidelines.

- We continue to believe this tidal wave of dividends will help the ASX find a meaningful low in the coming weeks, just in line with its usual seasonal pattern.

US stocks fell another -0.8% overnight taking the S&P500’s decline to -2.5% since the local market was last open, the SPI Futures are subsequently calling the ASX200 to open down ~1%. The market slipped lower for most of last night compounding losses from Wednesday, there was no major standout with even the VIX falling but the “Feds DOT Plot” which produced a median forecast of peak interest rates ~4.6% (up from 3.8%) in 2023 is clearly weighing on investors sentiment.

- Investors feel that the possibility of a soft landing for the economy is unlikely with US rates headed towards 5%.

- Markets “look & feel” horrible but they’re moving as we anticipated hence we see no reason to deviate away from our short-term bullish stance.