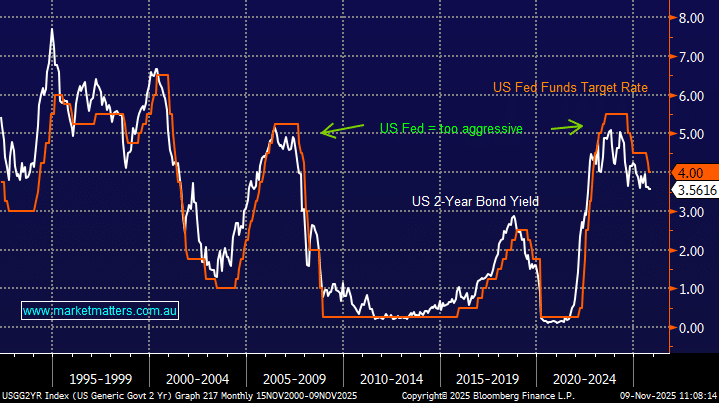

The ASX200 surrendered some of Mondays gains yesterday on broad-based selling after the RBA minutes and a speech from Deputy Governor Bullock heightened interest rate concerns sending the yield-sensitive growth stocks back into the loser’s enclosure.

- Michele Bullock said interest rates will have to go a “fair bit higher” although she feels households are well-placed to manage further increases.

- The RBA Cash Rate has been hiked from 0.1% to 1.35% since May with ANZ now predicting they will over 3% by Christmas, not much good cheer there!

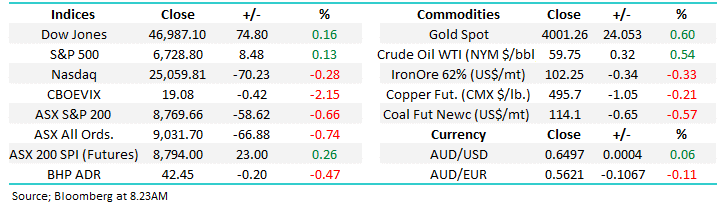

Overnight we saw US stocks surge higher putting in their best performance in weeks with the S&P500 closing up +2.8% on aggressive late buying as speculation grew that markets have bottomed out. Gains were strong across the board with a more than 3% gain for their Financials, Resources and Tech Sectors likely to help the ASX today, the SPI Futures are calling the local market up +1.25% early as it edges back towards its recent late June 6763 swing high.

- Even Netflix (NFLX US) surged +5.6% ahead of its earnings report as short covering appeared to wash through the market.