To reiterate/clarify the roadmap MM believes stocks will follow in this fascinating market which overall we do believe is “looking for a low”:

- Firstly the 6-8% bounce from the ASX200’s panic June lows is on track to be satisfied in the next few weeks, or sooner i.e. a classic short covering squeeze/rally i.e. if results are simply ok stocks are rallying.

- Secondly we believe risk assets will again eventually succumb to the very real problematic macro-economic backdrop but importantly we believe most of the downside journey is already behind us.

- Thirdly in an ideal world we will see another “failed spike” this time on the downside to yield an excellent risk/reward buying opportunity allowing us to fully migrate back up the “risk curve”.

However it’s important to remember it’s rare that markets follow anyone’s relatively short-term view, probably why Jim Steinman wrote the iconic lyrics for Meatloaf “Two out of three ain’t bad!”. However, we plan to tweak our portfolios in line with this roadmap and of course logical portfolio construction and underlying views towards individual stocks until our stance changes direction.

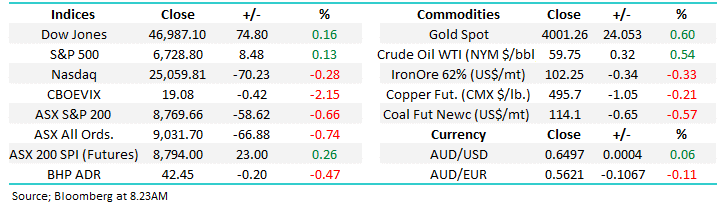

Overnight we saw US stocks remain firm with the tech-heavy NASDAQ up another +1.6% while the broad market rallied +0.6%, the SPI Futures are calling the ASX200 lower to the tune of ~0.4% as it takes its lead from soft European indices and commodities markets.