The ASX200 finally managed to close with a small gain on Tuesday and it currently appears that we will need a reasonable reporting season out of the US to help propel the ASX up ~4% towards our short-term target area, hopefully, investors have become too bearish into this week’s US inflation report.

- MM is still looking for a week’s rotation up towards the 6850 area but we remain mindful of the strong downtrend through 2022.

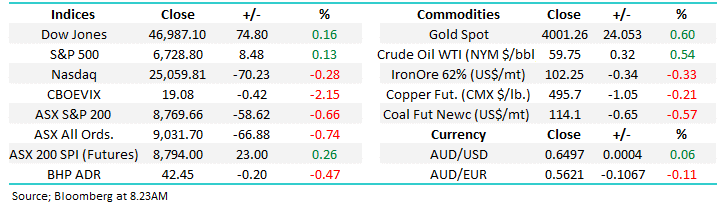

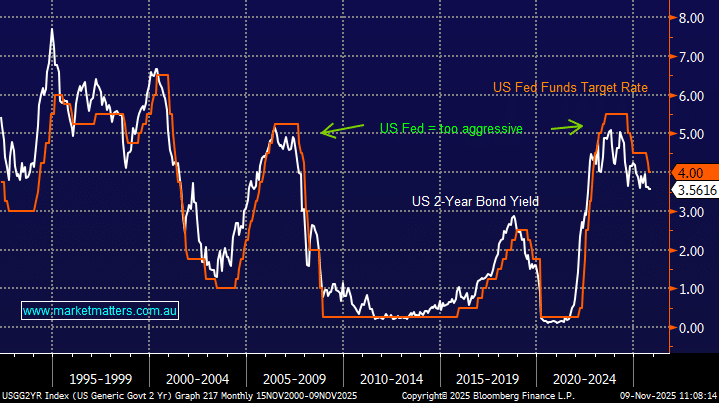

Overnight we saw US stocks slip further on recession concerns with the broad-based S&P500 falling -0.9% but the real action is being directed by bond yields which are flagging a looming recession as central banks continue to hike interest rates, ongoing weakness in commodity markets looks set to knock the Resources Sector even harder this morning although the SPI Futures are calling a flat opening by the broad market. Goldman Sachs’ view is that there’s now a 30% probability that the US will enter a recession, we feel bonds & equities are pricing things at closer to 50%, or even higher.

- Crude oil tumbled -7.8% while copper didn’t fare much better falling over 5% with the later testing levels not seen since 2020.