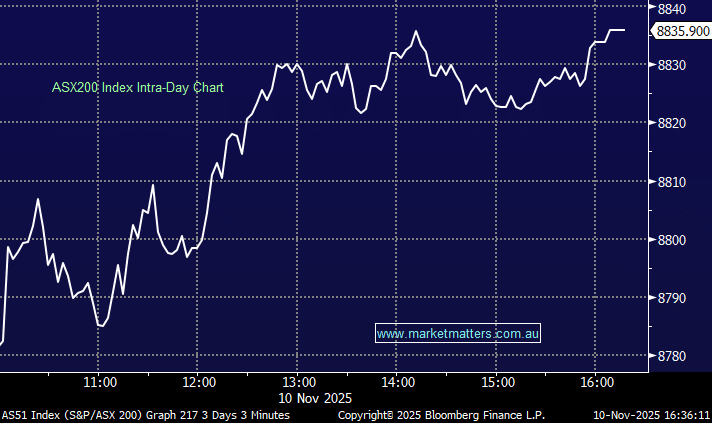

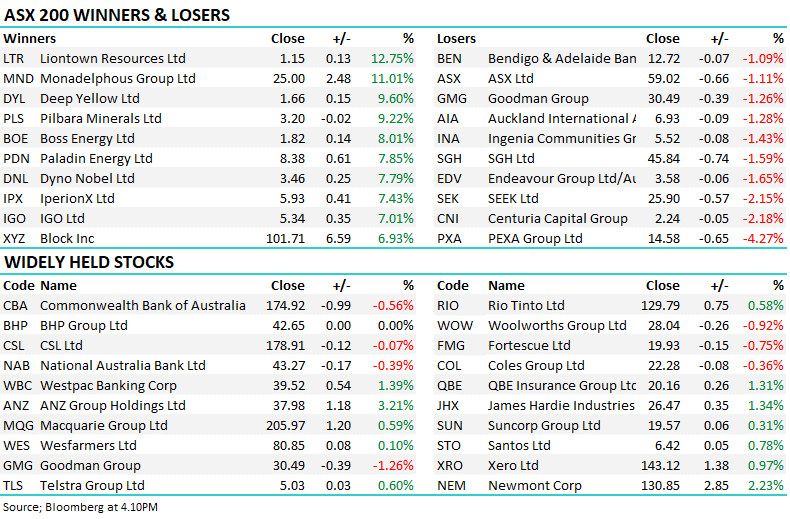

Yesterday saw the ASX200 eke out a small +0.25% gain following the RBA’s rate hike at 2.30pm – local stocks initially jumped on the news only to fall away in the last hour of trade as investors’ focus quickly switched to a weakening US futures market. By the days end, we had a balanced number of winners and losers with some noticeable buying entering the Tech and Gold Sectors with the former bouncing +1.7%.

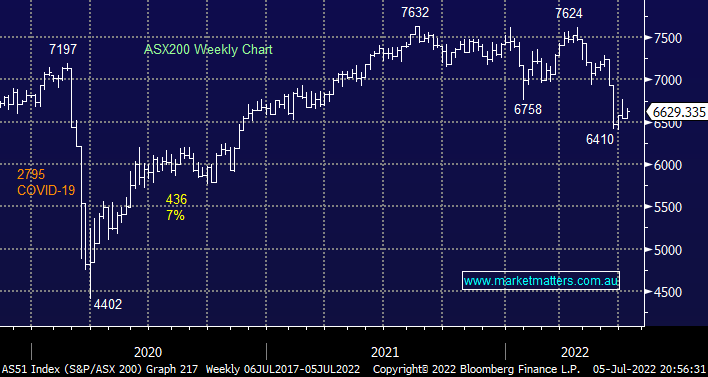

- MM is still looking for a week’s rotation up towards the 6850 area but we remain mindful of the strong downtrend through 2022.

Overnight US stocks reopened after the Independence Day long weekend with the S&P500 closing marginally higher helped a strong move in tech which rallied +1.7% but a sharp downturn in commodities prices as recession fears increased sent related stocks lower with odds of a US recession now priced at 38% according to Bloomberg Economics:

- An 8.4% plunge in crude oil and a 4.7% fall in copper will weigh heavily on the Australian Resources Sector today.