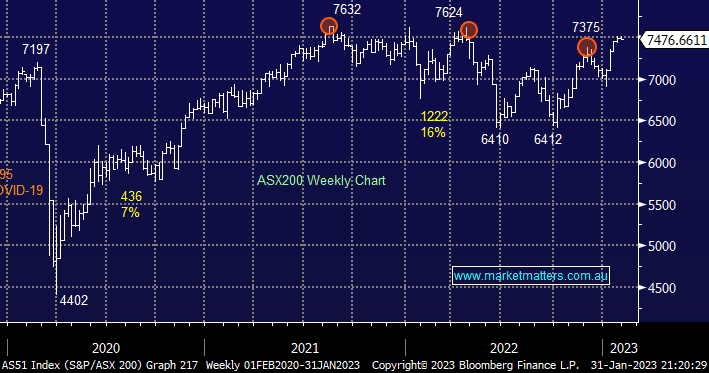

Tuesday saw the ASX200 fail again at the psychological 7500 area with over 60% of the main board declining however January has still proven to be a great start to a year which many were, and still are, calling lower – the +6.2% gain took the local market to its best close since March’22. The local market was again looking strong at 11.30 am trading up ~0.5% but a big miss by Decembers Retail Sales numbers saw the market fall away for the rest of the day to finally close mildly lower – clearly economic concerns outweighed hope that the RBA would take its foot off the pedal over the coming months as opposed to hiking cash rates from today’s 3.1% ever closer towards 4% – they were at only 0.1% nine months ago!

- The lag effect from mortgage hikes is set to bite over the next few quarters hence we believe there’s a good chance of volatility increasing which will bring with it opportunity.

- MM continues to believe selling strength and buying weakness will pay dividends through 2023 suggesting this is still not a great time to be chasing local stocks.

US stocks rallied overnight led by a return to favour by tech names after data hinted that labour costs are easing reversing early gains in the $US e.g. Amazon.com (AMZN US) +2.6% and Microsoft (MSFT US) +2.1%. Assuming the SPI Futures are on point the +368-point gain by the Dow looks set to help the ASX open up +0.6% back above 7500 helped by a 30c advance by BHP in the US.