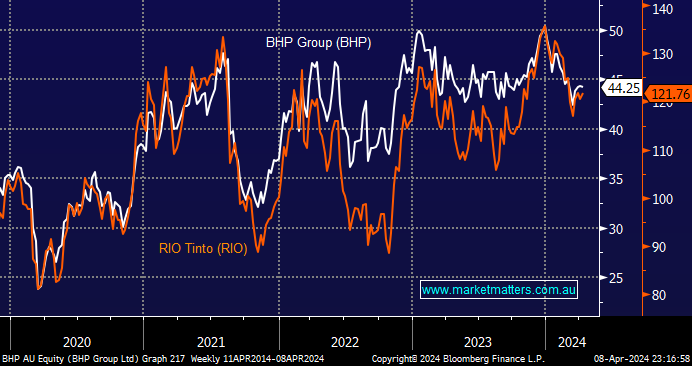

BHP and RIO are two stocks most closely followed by MM subscribers; just look at Saturday’s Q&A. Hence, it caught our attention when one of the leading stories in yesterday’s AFR was “Brokers go all in on RIO tipping 20% annual share price jump”, i.e., at MM, we’ve preferred BHP over RIO over recent years. They believe that RIO is better positioned for a boom in industrial metals, and they also think it has a stronger balance sheet. A glance at the two stocks shows they’ve pretty much danced in tandem since COVID, while so far in 2024, BHP is down -12.2% and RIO -10.3%, with iron ore weighing on both miners.

Having bought OZ Minerals (OZL), BHP presently mines more copper, but RIO is expanding faster. At the same time, the latter has a more considerable aluminium exposure and BHP coal. As we mentioned earlier, these cyclical commodities can prove challenging to predict. Currently, 37% of brokers rate BHP as a buy compared to 67% for RIO – a more detailed analysis of both stocks can be viewed on the Market Matters Website by clicking on the respective stock codes below.

- We don’t see a compelling reason to follow the herd and switch from BHP to RIO, but never say never.

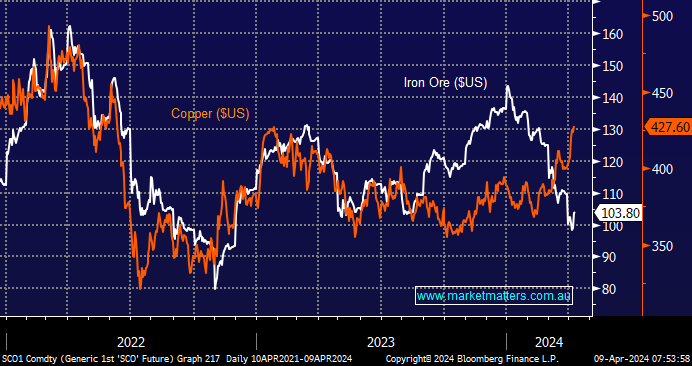

Bulk commodity iron ore and industrial metal copper have walked a similar path over recent years due to their correlation with Chinese economic growth, but it’s been a very different story through 2024, and we expect this divergence to continue until further notice.

- We can see the copper v iron ore elastic band stretching much further over the coming years (s) due to the industrial metals requirement for the world’s zero emissions goal.

This morning, we updated our stance on five of the major ASX miners; in general, we are bullish commodities, but as copper and iron illustrated, not all will rise as one.