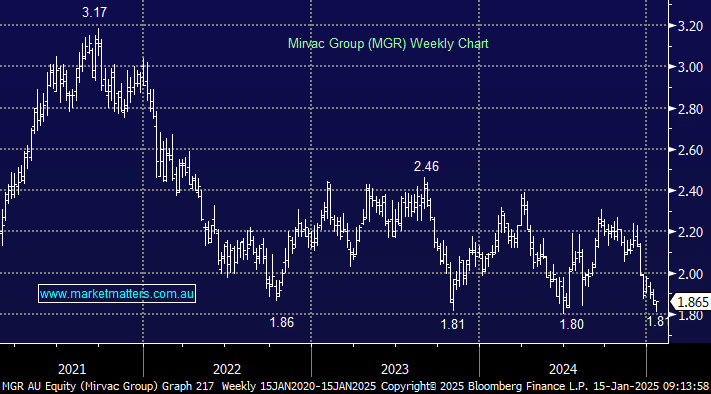

Mirvac (MGR) has pulled back to support around $1.80 as bond yields have risen globally. We believe the pullback in the property sector more broadly is a buying opportunity ahead of results in February. We are increasing our target weight from 4% to 5%.

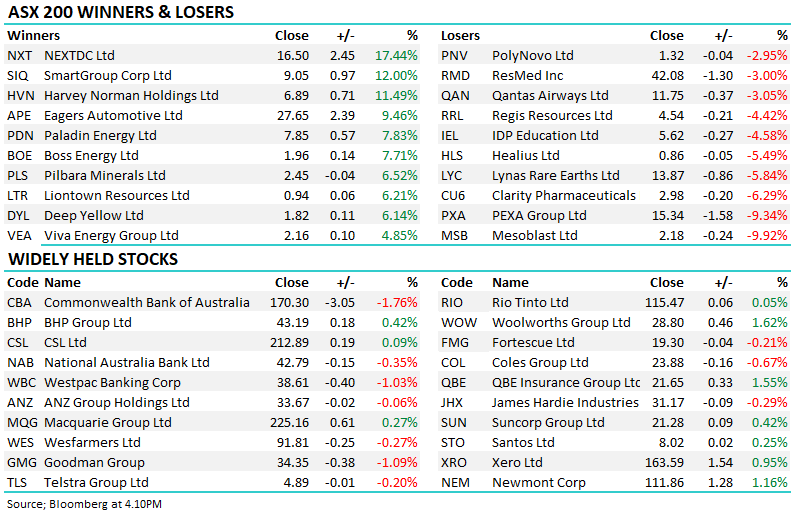

Paladin (PDN) had a poor 2H24 as they pushed to acquire Fission in Canada, and downgraded production. We believe 2025 will be a lot better year. With the decline in the stock price, the actual position size in the portfolio has fallen towards 3%. We are reinforcing our 4% target weighting and adding to our position inline with that.

We also hold PDN in the Emerging Companies Portfolio, tacking the same approach.

NB: Given several questions from members at the end of the year around actual portfolio weights vs target weights, we will now be sending updates when we are taking action to realign towards targets.