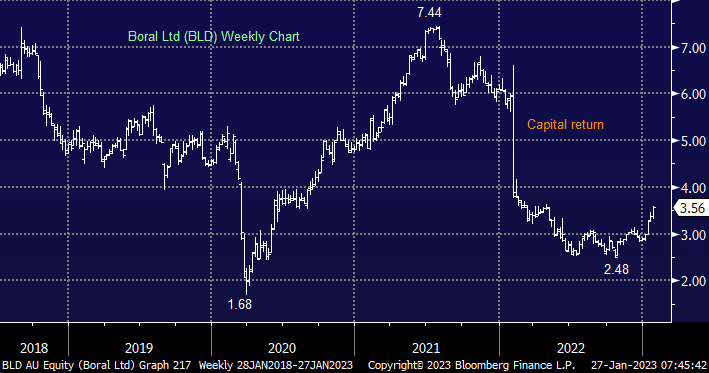

BLD is not a clear-cut picture because of its $2.65 capital return in March but in a similar fashion to JHX the stock has started to regain some investor interest after its significant decline over the last 18 months i.e. some long-term bargain hunters appear to be circling. Boral has been targeting strong price growth which they believe (combined with further cost control) will offset the impact of significant cost inflation, energy levels are likely to remain elevated making this a tough balancing act which leads us to be cautious chasing this building materials business into strength.

- We are targeting the $4 area for BLD but the risk/reward is diminishing fast as the stock rises strongly from $3.