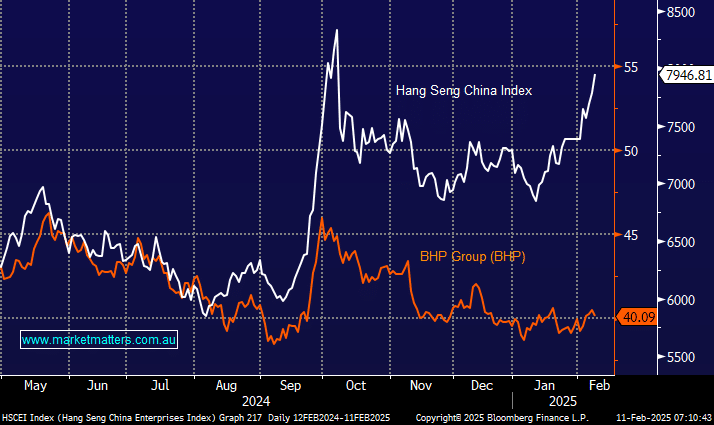

Can our miners follow Chinese stocks higher?

We believe investors are ignoring positive economic developments and opportunities ahead in China due to broader geopolitical concerns, tipping the risk/reward very much in favour of the market. China is poised for economic stimulus and significant structural changes that will set corporates up for strong returns, especially after Beijing signalled its intent to stimulate its economy last September.

BHP Group (BHP) $40.09

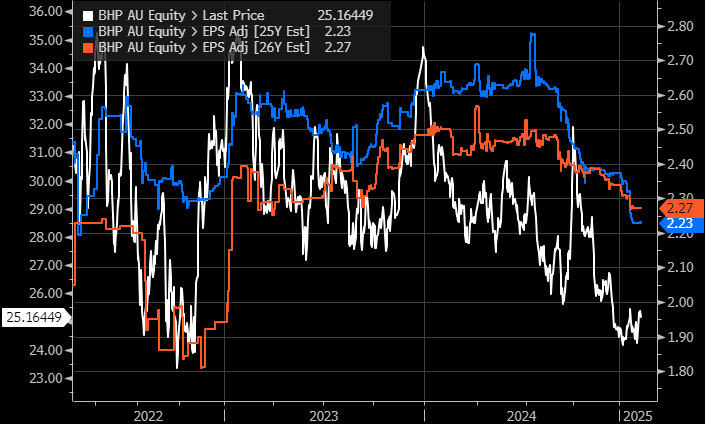

BHP, the “Big Australian,” has been a laggard on the ASX and compared to Chinese stocks. The main reason is the much-discussed outlook for iron ore, with significant production coming online later this year. BHP is due to report next week, so we can expect some volatility, but bar any surprises, we believe its share price will be driven by commodity prices and forecasts, with the latter being one area in which we can see begrudging upgrades this year.

- BHP’s share price has underperformed declining earnings estimates, giving room for upside surprises.

- We can see BHP trading back above $45 in 2025: MM is long BHP in its Active Growth Portfolio and Active Income Portfolio.

Fortescue Ltd (FMG) $18.29

FMG has lagged BHP when it comes to dancing with Chinese stocks, which is no surprise as it’s a pure iron ore (Fe) play. We don’t anticipate a strong move by China’s equity market to drag FMG higher, but we’re already seeing some analysts soften their bearish outlook for Fe, especially short-term, which will push FMG’s share price higher if it gathers momentum. Similarly, if we see further strong stimulus out of China, lifting Fe above $US110/MT, begrudging upgrades could follow with analysts not wanting to be last to the party.

- We like FMG for its yield and potential for growth, and we can see a test of $22 through 2025 – MM owns Fortescue in our Active Income Portfolio.

Sandfire Resources (SFR) $10.59

The correlation between Sandfire and Chinese stocks is uncanny. In line with our positive outlook towards China, we’re looking for a strong run by SFR over the coming months, with 10-12% upside looking likely.

- We can see SFR testing $12 in 2025: MM is long SFR in its Active Growth Portfolio.

Iluka Resources (ILU) $4.65

ILU became a frustrating “recovery play” for MM after disappointing updates around its Eneabba rare earth project and ongoing challenging conditions for Mineral Sands as the Chinese economy struggled through 2024. While ILU has only a loose correlation to Chinese equities, it is leveraged to its economy, and this is where we can see surprises on the upside—remember equity markets lead, suggesting we should see an improvement in the world’s second-largest economy this year. We would be looking to buy ILU if we weren’t already long.

- We can see ILU initially testing $5.50 in the coming months: MM is long ILU in its Active Growth Portfolio.