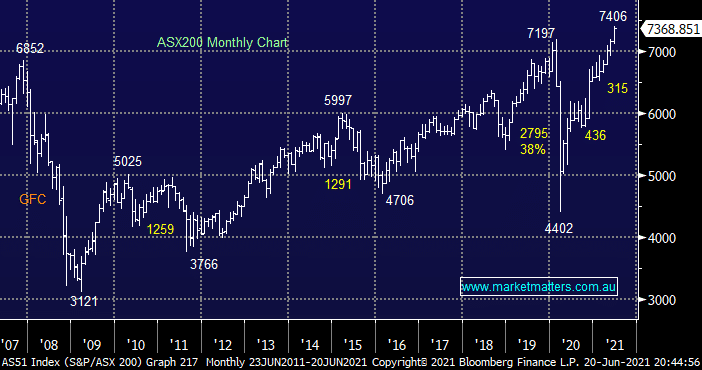

The ASX200 pushed ever higher last week taking its advance to ~12% year to date but following sharp losses in the US on Friday this week’s going to start off on a very different footing, the SPI futures are calling the local market to open down -1.5% this morning, wiping out over half of the months gains in one fell swoop. The combination of central bank comments and strong economic data both locally and overseas has investors bringing forward their forecasts for when interest rate hikes will commence which appeared to be the catalyst to send the Dow plunging over 500-points on Friday:

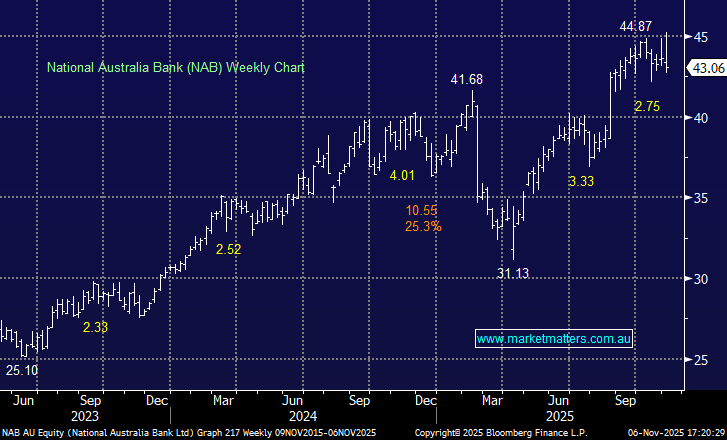

- Following Australia’s sharp decline in unemployment influential Westpac economist Bill Evans has now brought forward his forecast for when the RBA will commence raising rates to Q1 of 2023.

- Similarly the US Fed is now flagging 2 rate hikes by the end of 2023 as their post COVID economic recovery gathers momentum.

Last week felt like a fascinating workshop of looking through the obvious to understand what’s driving share prices on all levels. Today we will expand on the below 3-points and most importantly bore down into how MM anticipates reshaping our respective portfolios through the current and future macro market moves.

- As mentioned earlier investors & economists have brought forward their estimates of when central banks would start hiking rates.

- However the closely followed US 10-year bonds fell to their lowest levels in 3-months leading to significant outperformance by the IT and Healthcare Sectors i.e. the growth stocks.

- The prospect of higher US interest rates next year finally sent overseas shares tumbling on Friday following comments from influential FOMC member James Bullard who predicted rates would actually rise in 2022, sooner than the Fed implied.

As we’ve stated a number of times this year MM believes it’s a matter of “when not if” interest rates would rise both here and overseas, at the moment as the week to week vagaries of economic statistics cross our screens the only question come Friday afternoon is which month are most pundits now guessing rates will indeed rise – I deliberately used the word “guess” because it feels the most accurate word and realistically a quarter here or there shouldn’t make a major difference to how investors structure their portfolios.

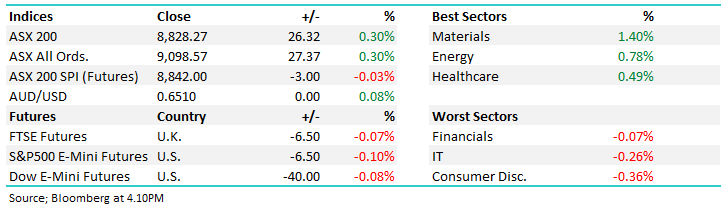

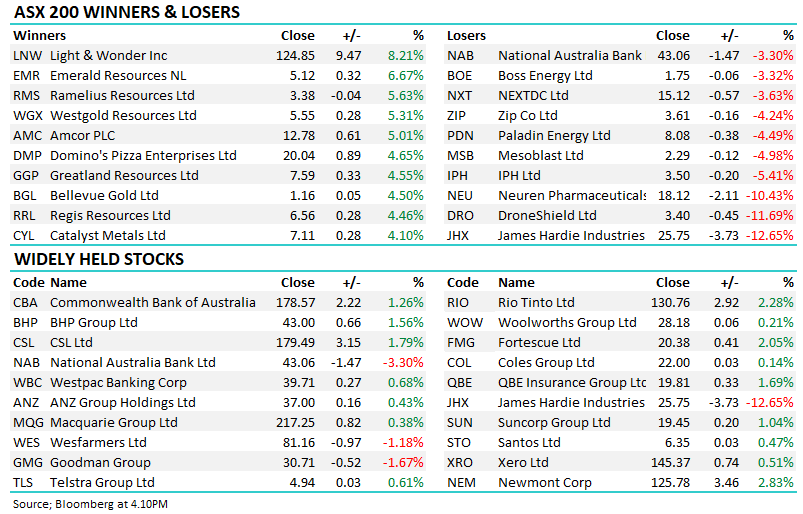

The losses on Friday night were concentrated in the Financials and Resources Sectors which doesn’t bode well for the ASX this morning and the -1.5% gap down early on today feels about right with BHP Group (BHP) dropping exactly -1.5% in the US.