The ASX200 again posted all-time highs last week as a little profit taking in the banks was more than offset by broad based buying across the market led by the IT Sector as bond yields slipped lower removing the headwind which has been suppressing the growth stocks through most of 2021 – our focus today will be on these very same bond yields which have dictated the sector rotation over the last 6-months.

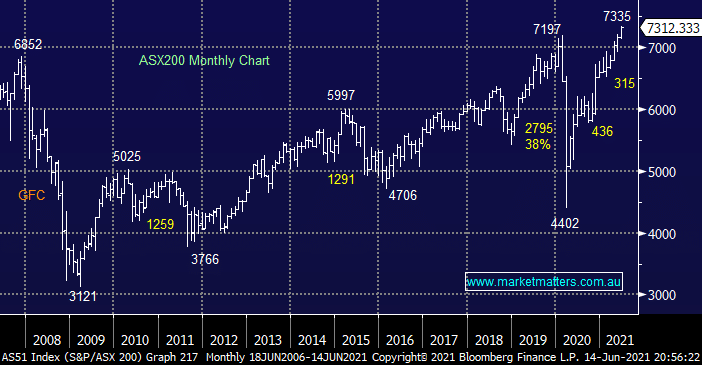

I read a lot of financial press from company reports to technical analysis and the only thing that hasn’t been crossing my desk throughout this year is how long will it be until the local index hits 8000 although it’s now only 9.4% away. In our opinion the bears should be a little more open-minded, statistics tell us that buying breakouts is far more rewarding than selling them and at this stage the ASX200 has risen above its 2020 high by ~2%, hardly panic buying in anyone’s language. Seasonally most of us have heard of “sell in May & go away” but this phrase is beholden to statistical averages and the aggressive stimulus that’s washing through financial markets post COVID is most definitely not an average phenomenon:

- The US Fed is continuing Quantitative Easing (QE) at ~$US100bn per month pushing up inflation by 5% year on year but like most other global central banks they appear scarred to turn off the tap and see the party end on their watch – sounds like politics!

- While interest rates remain around zero and QE’s in play equities will look extremely attractive compared to alternatives.

- Seasonally US stocks usually chop around between May and October with increasing volatility before regaining their mojo in October, a period of consolidation similar to late 2020 / early 2021 feels close at hand but MM still believes pullbacks should be bought.

Whether we consider either the GFC or COVID “fighting the FED” has been a futile game and while we have no doubt that when QE4 is removed assets will correct it could easily be from much higher levels than many believe possible. So far in 2021 the ASX200 has rallied +11%, still marginally below the average annual return of the last 40-years which arguably leaves plenty of room for further gains when we consider the subdued COVID levels we commenced the year. However if we consider the property market stocks might just be getting going, Sydney housing prices are up almost 15% in 2021 with another 6% forecast by an RBA survey by Christmas, if the ASX200 rallies by the same degree we will be over 7900. Hence until further notice MM believes investors should play stocks from the long side with most efforts being directed at sector then stock selection.

Following another mixed session on Wall Street the ASX200 looks poised to open up around 60-points relative to Fridays close with tech likely to continue its outperformance in line with US indices.