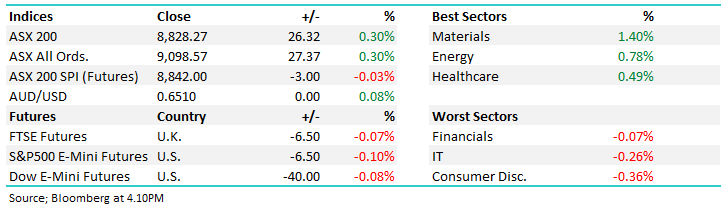

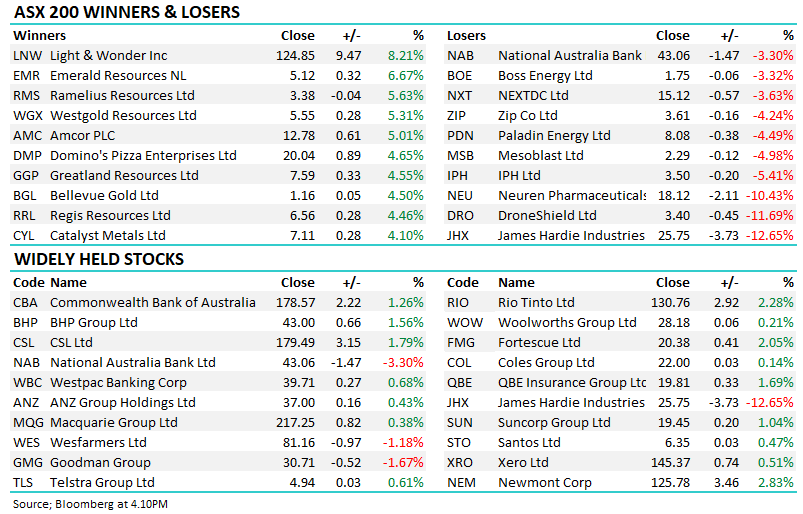

The ASX200 started to show a few hairline cracks yesterday with strength early on sold into as ~60% of the index finished lower after hitting another all-time high at 7334. The supermarkets were the standout underperformers following a weaker than expected consumer sentiment survey however it simply felt like some of the buyers across the market pulled up stumps and we drifted lower into the close.

Building materials company Brickworks (BKW) was out with a positive update and the stock hit a new all-time high, this is a company that is enjoying the strength currently playing out right across the property spectrum from prices to activity levels and they’re taking advantage of the underlying strength. We also saw gains across the material stocks with Iron Ore prices continuing their strong run, however overall it was another fairly lacklustre session for the local market.

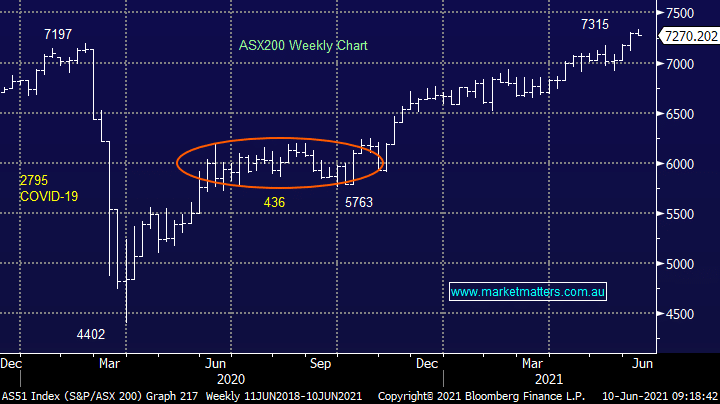

As the local market sits at all-time highs it wouldn’t be a surprise to MM if we saw some consolidation play out, a pause as we digest the recent strength in markets however with a backdrop of low rates and a strongly growing economy, it feels like stocks will continue to benefit from the buoyant economic backdrop. I have a very broad client base operating in many different parts of the country and the clear message is that things are good, although less so if you’re a Queenslander this morning!

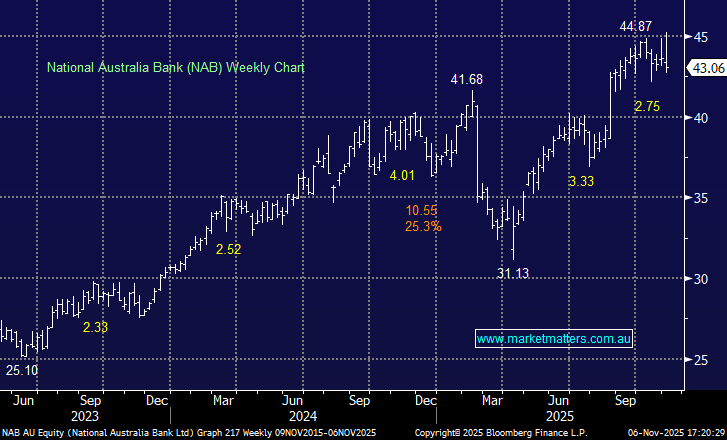

Overnight US stocks were largely flat for most of the session before a late sell-off into the close saw the market close lower. The banks were weak offset in part by technology and biotech stocks, the SPI futures are pricing a flat start to trade this morning however that feels a little optimistic given weakness overnight in the sectors that are most influential to us.