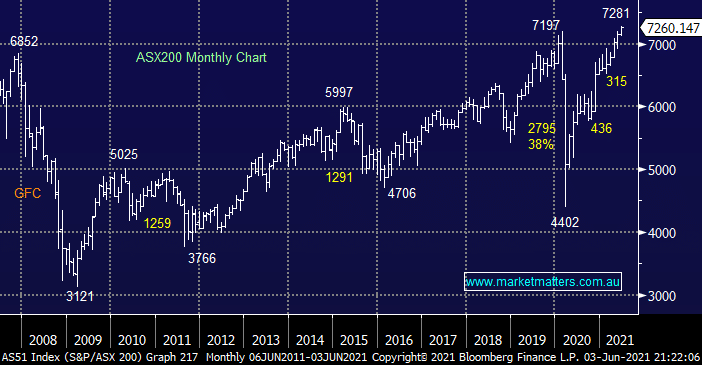

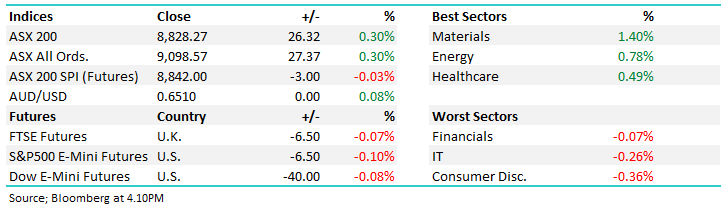

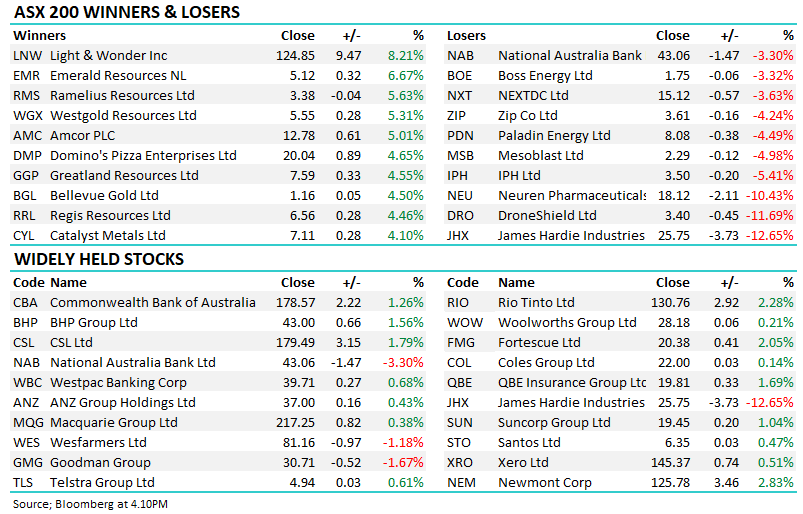

The ASX200 keeps posting fresh all-time highs almost as often a day ends with a “y”, earlier this quarter MM was optimistically discussing the major Australian benchmark breaching 7000 but around midday on Thursday 7300 was feeling more likely. Ultimately the market surrendered around 30% of its gains but it still closed up +0.6% although less than 60% of stocks rallied. The financials and energy stocks again stood out in the winner’s circle while the losers were more scattered across the market.

The rhetoric remains the same, the world is awash with cash and its driving up asset prices with global housing prices jumping the most in 14-years, the press keep talking about bubbles but I’m really glad I own my house e.g. this week the AFR reported that South Turramurra on Sydney’s upper north shore has jumped an incredible +20% in the last 3-months, cash is most definitely not king today. With so many people calling a correction / bubble in assets we must remain open-mined that we could be testing 8000 in a years’ time, its only 10% away or a few months in today’s housing market.

Through May we were positioned for a 5-10% pullback which wasn’t forthcoming leaving our portfolios a little overweight cash for a market threatening to surprise many on the upside hence we are on the lookout to pick up more bargains – our last 3 purchases in the growth portfolio are already showing great paper profits which is probably telling us something e.g. Whitehaven Coal (WHC), carsales.com (CAR) and HUB24 (HUB).

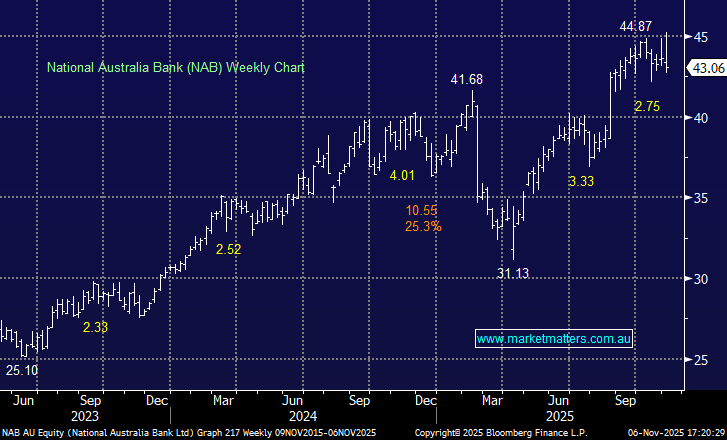

Overnight US and European equities slipped lower although a report that Joe Biden was considering a lower corporate tax rate arrested much of the fall late in the day. The NASDAQ continues to lead the losses falling over -1% but strength in healthcare and financial stocks has given the SPI hope and its calling the ASX to open basically unchanged even with BHP Group (BHP) falling 60c in the US.