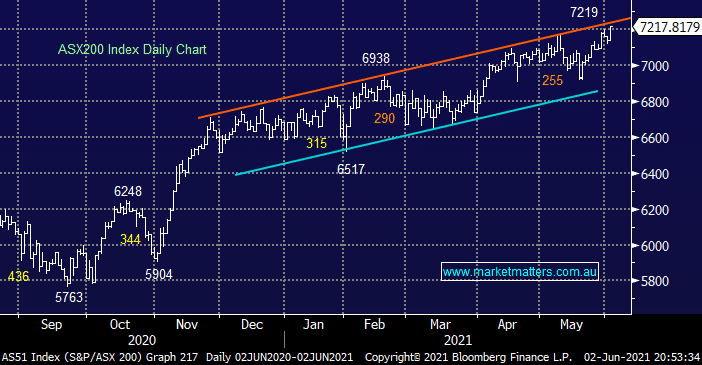

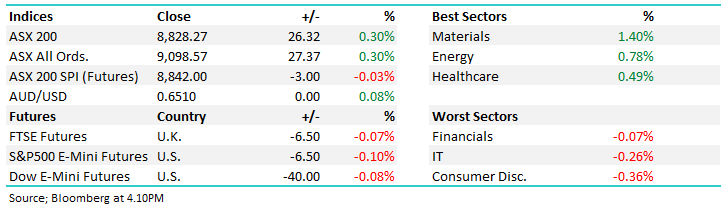

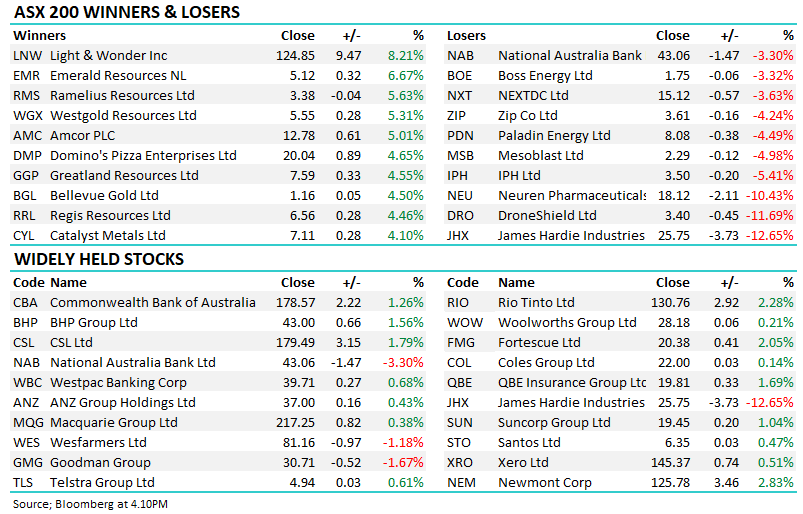

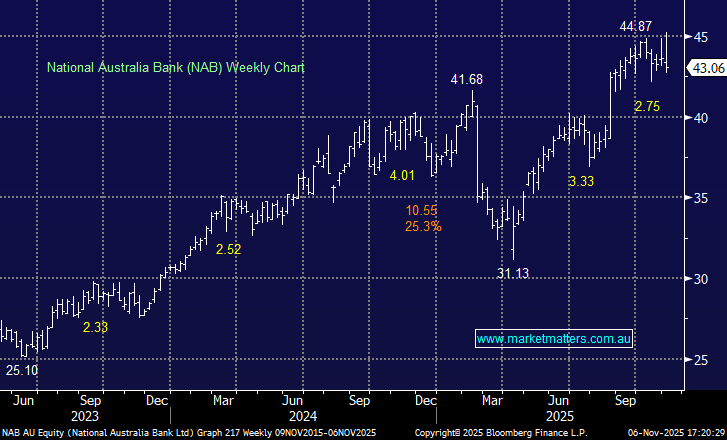

The ASX200 continues to grind higher posting new all-time highs on an almost weekly basis, Wednesdays 75-point rally was a strong broad based performance with over 70% of stocks closing higher led by the energy names while being well supported by the miners and banks. The growth names were the standout underperformers as strong GDP numbers implied the pandemic was well and truly in the rear view mirror, perhaps suggesting to some that interest rates might be hiked sooner rather than later.

However although the economic data remains strong bond yields and the $A paid very little attention at 11.30am, it was only the rotation from growth names to value which appeared to embrace the strong growth numbers i.e. GDP grew at +1.8% for the March quarter compared to +1.6% expected. My feeling is the days theme of “sell Healthcare & IT to buy resources and banks” would have probably unfolded whatever the data, within reason. MM continues to watch bonds and the $US for a trigger to fade yesterday’s sector moves but patience is paying off for now.

The Australian market has maintained its strong correlation with Europe with both the AXS200 and EURO STOXX 50 positing fresh highs this week, MM does believe some consolidation is due however statistically selling new all-time highs is a strategy which results in losses. On the index level we remain happier buyers of pullbacks than sellers of strength.

Overnight US and European equities edged higher helping the SPI futures to edge up +0.2%, with the resources trading strongly in the US yesterday’s relative sector performance looks likely to be ongoing.