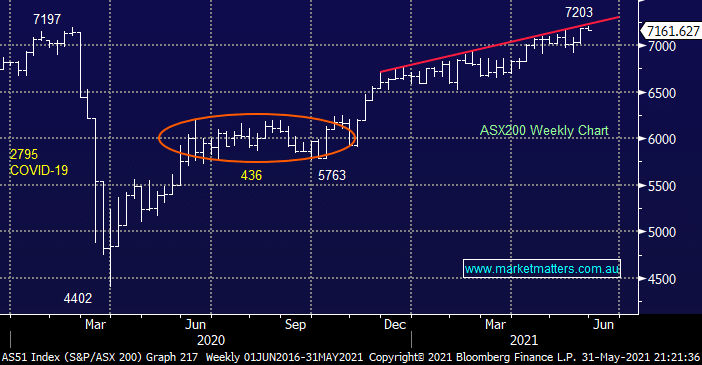

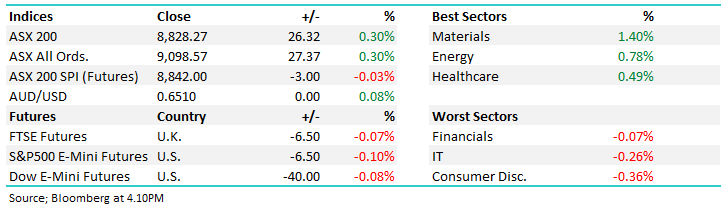

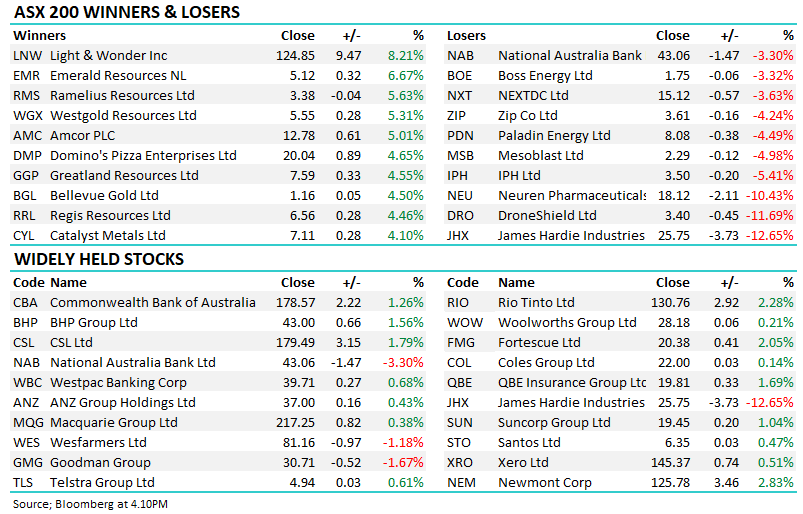

The ASX200 had a fairly quiet end to May as yet again it failed to push through its trend line resistance which has contained the markets advance since November of 2020. Ultimately local stocks reversed early gains to close down -0.25% with only the Healthcare & Gold sectors contributing any noticeable support. Even Commonwealth Bank (CBA) closed lower after posting a fresh all-time high at $101.50 – I’ll go out on a small limb here and call CBA to retrace ~5% from yesterday’s high, a point of interest no more as we remain bullish.

As Victoria registered another 11 fresh COVID cases yesterday a few pockets of the market finally appeared to become nervous with the travel and tourism sector coming off the boil e.g. Corportae Travel (CTD) -3.2% and Webjet (WEB) -2.5%. However the minor pullback suggests nobody’s really taking the outbreak seriously, fingers crossed they’re correct and we don’t follow the likes of South Korea and Japan into a far more serious wave.

We remain comfortable holding reasonable cash levels across the MM portfolios – although as we’ve said a few times recently MM remains keen buyers of the next reasonable pullback in equities. Importantly when it does finally unfold the news is likely to be poor, or worse, hence this is the time to set plans / traps because it will be easy to run for cover just when its likely to be the ideal time to buy i.e. things usually look & feel the worst at a low.

Overnight US stocks were closed for Memorial Day but the futures continued trading and they closed down ~0.25% across the board which didn’t help the SPI futures which is calling the ASX to open down around -0.5% this morning, appearing to largely take a negative lead from Europe.