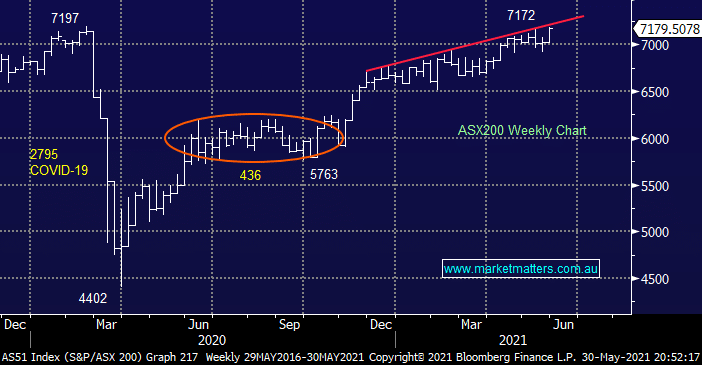

May has just one day remaining and barring any calamity its going to be another solid performance for the ASX200 with a gain of over 1%, the banks have led advance with Commonwealth Bank (CBA) surging almost +13% while the recovery stocks have played a solid supporting role. On the reverse side of the ledger the major growth sectors have dragged the chain i.e. the IT and Healthcare Sectors.

- Overall May has been surprisingly quiet with an average gain of just a few points per day but on the sector level it’s been fascinating although not a conclusive picture:

- The banks remain very strong with no apparent weakness at this point in time and as we love to say “the ASX doesn’t go down without the banks”.

- The IT stocks feel like they’re “looking for” a low and may have even found it a few weeks ago.

- The resources are “wobbling” and look vulnerable to any recovery in the $US.

Following an eventful but net positive session on Wall Street on Friday the ASX200 is poised to open around its all-time high this morning, a break of 7200 has a feeling of inevitability about it but we still believe the risk / reward is not compelling to be aggressively chasing the current strength. Historically when the local market grinds higher with this style of rally it usually unfolds for longer than many expect but ultimately they’re often followed by decent pullbacks for better entry levels.