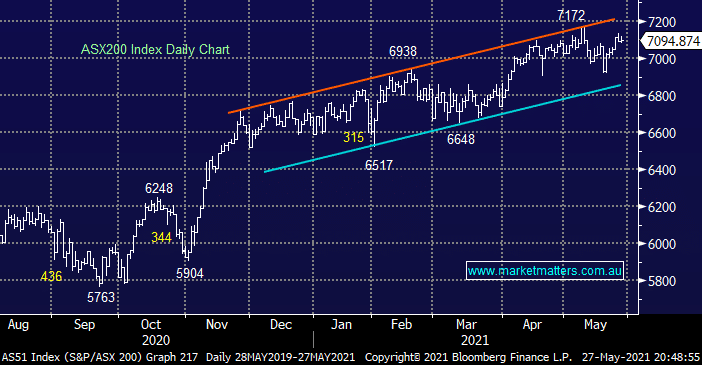

The ASX200 had the quiet Thursday we flagged in the morning report with it finally grinding out a meagre 2-point gain as just 51% of the market closed positive, on the sector level the banks drifted which was more than countered by another strong session from the IT names and a solid bounce by the Resources Sector. The rest of Asia was also half asleep and its feeling like investors are simply relieved that May is almost behind us.

As all subscribers would know Victoria has gone back into a 7-day lockdown following the news that its COVID cluster had grown to 26 cases with strong evidence the numbers are at serious risk of rising exponentially. However the financial markets shrugged off the news as no more than a minor irritant with the $A, ASX and local bonds all closing basically unchanged. It seems the Coronavirus remains old news unless we see a breakout by a strain which the current vaccines cannot immunise against.

We continue to see some buying creeping into the markets under achievers with AMP’s pop yesterday definitely an extreme example. We allocated 2% of the MM Growth Portfolio into a2 Milk (A2M) on Thursday afternoon which is an aggressive play after the dairy business has more than halved in 2021 but we feel a strong bounce over the next 6-months has become a strong possibility making the risk / reward appealing – again we’re sorry that some subscribers didn’t receive the email alert until after the close.

Overnight US stocks were mixed with the Dow closing up +0.4% while the NASDAQ slipped -0.3% following solid economic data plus news that Joe Biden was set to announce a $US6 trillion spending package, the combination sent investors pouring back into the banks and resources stocks i.e. the value end of town. The SPI futures are calling the ASX200 to open up over 50-points this morning with BHP Group (BHP) bouncing +2.4% clearly a nice tailwind.