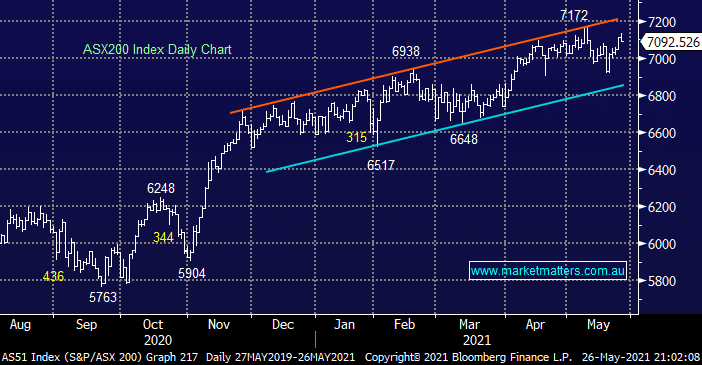

The ASX200 followed Commonwealth Bank (CBA) higher into lunch as the markets largest company joined the $100 club, the stock listed back in 1991 at $5.40 illustrating the power of long-term compound investing when you back the correct business. Unfortunately the index encountered plenty of selling into strength yesterday above 7100 and by the close the market had reversed the mornings gains to close down -0.3%. Under the hood the story of the last 3-weeks continued with the IT sector rallying over +1% while the resources fell by around the same degree with heavyweights BHP Group (BHP), RIO Tinto (RIO), OZ Minerals (OZL) and Fortescue Group (FMG) all struggling, finally closing down by over 2%.

If we are correct and the $US is looking for a major low in typical equities fashion the growth stocks are pre-empting a period of outperformance when compared to the value sector. Hence we are not yet in a rush to wade back into the resources space believing many of the quality names could easily correct another 8-10%. Interestingly through history this is a common phenomenon with stocks regularly leading the news e.g. at the end of a bear market gold stocks usually turn higher before the underlying precious metal, a trigger bullion traders watch carefully.

BHP Group (BHP) is illustrating perfectly the aggressive sector rotation which the ASX has already witnessed so far in 2021. After posting new all-time highs only a fortnight ago we’ve seen a fairly dramatic -10.6% correction taking the global miner back to where it was trading in early January. Undoubtedly the phrase “sell strength & buy weakness” is flawed on many levels, especially during major bull & bear markets, but MM still believes the equity bull market is maturing hence MM feel it’s a catchphrase that will add alpha in a year which we continue to believe will be characterised by plenty of choppy / volatile swings, especially on the stock and sector level.

Overnight US stocks closed marginally higher with the small caps springing back to life rallying +2%, the SPI futures are calling the ASX to open basically unchanged on what’s threatening to be a quiet Thursday.