Firstly, it was a cracking morning in Sydney with the view from the office as the sun came up over the harbour. That’s looking towards the heads, the harbour bridge to the left.

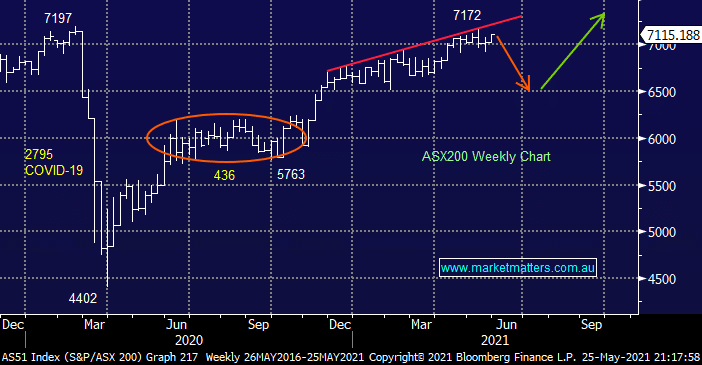

Now to markets, the ASX200 appears to have quickly put last weeks “May jitters” behind it as the index rallies towards both its 2021 & all-time high. Another day of Commonwealth Bank (CBA) scaling fresh levels certainly helped but the buying was broad based with 75% of stocks closing positive although I did feel it was more a lack of sellers that was the main market driver but either way the result’s the same, the post GFC & COVID bull markets remain intact.

When MM discussed the banks yesterday we thought that Bendigo Bank (BEN) might hold the best upside potential moving forward as investors scan the sector and market underperformers in search of value i.e. as bull markets mature historically many “weaker” companies play some performance catch up as bargains become increasingly thin on the ground. Yesterday illustrated this might already be unfolding on the short-term level, just look at the leader board:

- Tuesdays top performer HUB24 Ltd (HUB) rallied +9% after falling almost -18% since the end of April.

- The silver medal went to Kogan.com (KGN) which bounced +6.6% after collapsing more than -30% over the last 3-months.

- the bronze position went to Pilbara Minerals (PLS) which rallied +5.1% after correcting -23% over the last month.

- 4th position went to carslaes.com (CAR) which MM bought recently, it rallied over +5% after falling 25% from its 2021 high

- lastly the 5th position went to Seek (SEK) which bounced +4.7% after correcting over -15% this month.

As we often say “one day doesn’t make a Summer” but we do feel the “buy the dip” mentality which has been prevalent since COVID remains in play on many levels. Hence MM is happy to sell strength and buy weakness as the market continues to grind higher with the average gain in 2021 being around 20-points, or ~0.3% per week.

Overnight we saw US stocks give up the gains their futures were flagging during our time zone with the S&P500 reversing to close around its lows, down -0.3% on the day. The SPI’s pointing to a ~0.5% drop early this morning and with BHP Group (BHP) down over $1 / 2.3% in the US it feels warranted.