Yesterday saw the ASX200 tumble almost 2% as the “buy the dip” early morning attempt was thumped back into place by fairly aggressive selling across the board, 90% of stocks fell while the futures saw their volume double as worries clearly surfaced through investors’ minds. All 11 market sectors fell with the previously high flying banks and resources catching my eye as profit taking was clearly the order of the day in the value end of town.

Interestingly inflation is getting the blame for the current market jitters, the AFR lead last night with “Shares suffer bruising fall as inflation worries mount.” We think the scribes have got this one wrong otherwise bond yields would be rallying as opposed to treading water, growth stocks would be underperforming value yet we’re starting to see flickers of reversion on this front with the resources in particular being targeted by sellers on Wednesday – investors have short memories and we are in May plus leverage is at record highs, elevated cash levels remain logical to MM at present.

Overnight the Fed minutes were released with a couple of significant points catching my eye:

- The board was optimistic around the US economy.

- Hence they are open “at some point” to scaling back bond purchases i.e. yields / interest rates appear to have formed a major bottom.

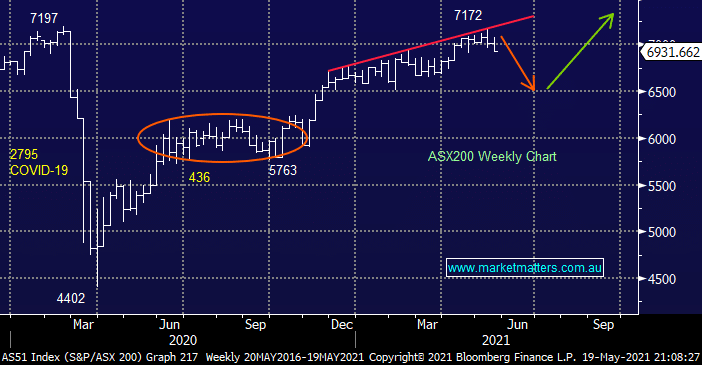

Equity markets have been driven higher over the last decade of “free money” but with the stimulus tap in danger of being turned off or at least reduced MM still anticipates volatility to remain elevated. In just a few sessions May has lost all of its gains and the psychological 7000 level has slipped into the rear view mirror, remember if this May / June simply retraces the average of the last decade we should at least dip under 6700. MM has our “buyers hat” firmly in place but our ideal target for the ASX200 is lower while the US S&P500 looks on track to fall another 6-7% lower hence we are remaining patient for now but if this pullback unfolds as expected our Flagship Growth Portfolio is likely to see its cash holding fall from 14% to under 5% cash in fairly rapid fashion.

Overnight US stocks experienced major intra-day swings following the Fed minutes with the Dow finally closing down 164-points after being down almost 600-points at its worst, the tech based NASDAQ actually closed positive in line with our comments above. The SPI is calling the ASX to open unchanged but it’s going to have to contend with a weak resources sector e.g. BHP closed down another 2% in the US.