The ASX200 bounced strongly yesterday gaining +0.6% as the choppy rotation continues, Tuesday was all about the resources from energy to gold and of course iron ore which continues to swing around with almost as much volatility as Bitcoin! Interestingly under the hood the broad market was weak with more stocks falling but again it wasn’t the ones that mattered from an index perspective.

Overnight we saw the $US slip to its lowest level since late February as the greenback / bond yields continue to drive equity markets on the stock / sector level, it remains a simple equation:

- a weak $US is creating a strong tailwind for the Resources Sector similar to yesterday but we envisage increased volatility around current levels that’s likely to flow through to stocks.

- previously when we have seen decent bounces in the $US our miners have stuttered at times although their underlying trend has remained clearly bullish. The main benefactors of a bounce in the $US has been the Tech Sector.

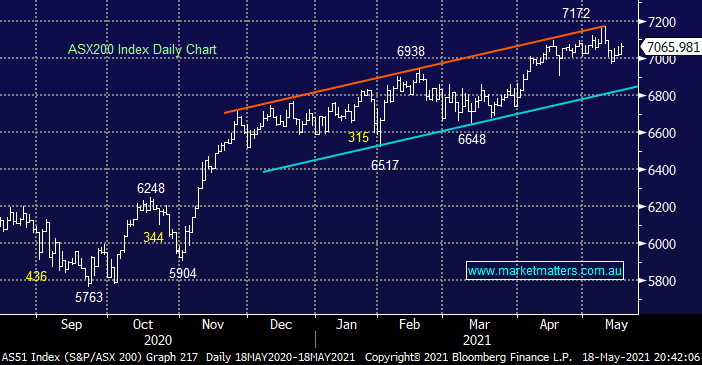

Overnight we saw US equities reverse early gains to close on their lows as inflation concerns intensified, locally the SPI is calling for a weak start with the ASX tipped to open down around 80-points, well under 7000 plumbing fresh lows for May. At MM we continue to target a pullback at minimum to test trendline support ~3% lower although our preferred scenario is a at least another 5% to the downside.