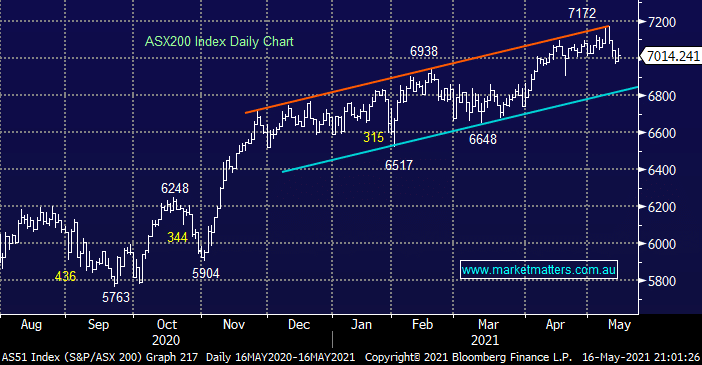

The ASX200 endured some May wobbles last week falling almost 3% by Thursday afternoon, subscribers should remain conscious that the average decline for May & June combined over the last decade is -4.8% which by definition means at its worst the intra-month pullback would have been deeper e.g. last year we saw a -7.7% retracement even while the market was enjoying a phenomenal post COVID recovery. Hence at this stage MM is comfortable holding portfolios with elevated cash positions looking / hoping to accumulate into any further market weakness.

Over the weekend the news was a continuation on recent themes:

1 – A deterioration of the situation between Israel and Palestine, this is likely to keep the crude oil price around its current 3-year highs although our Energy Sector is paying little attention trading noticeably lower than it was 12-months ago.

2 – Asia is seeing its COVID re-opening plans fall into disarray with Taiwan currently experiencing its worse outbreak since the start of the pandemic – MM still believes it’s too early to take a contrarian stance towards travel & tourism.

3 – Housing prices in Australia’s major cities remain very strong although the almost panic like buying that’s been witnessed through much of 2021 appears to have tempered slightly. Victoria threw a dampener into the mix over the weekend announcing a planned increase to stamp duty, a polar opposite move to NSW’s recent discussion’s.

Following strong gains in the US on Friday night the SPI futures are calling the ASX to gain ~0.7% this morning but we caution the market feels like its evolved from “buy the dip” to “sell the bounce” hence MM wouldn’t be surprised if we see the high for the week early on today but being investors as opposed to traders it’s more a point of interest as opposed to significance.