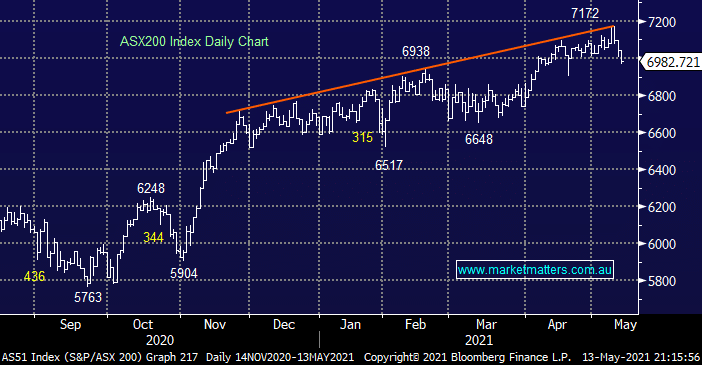

Yesterday saw the ASX200 fall another 62-points finally breaching the psychological 7000 area in the late afternoon, selling was fairly broad based with well over 60% of stocks down on the day although gains in the heavyweight banking & healthcare sectors stymied the losses. As expected the IT stocks led the descent tumbling almost 5% plus the resources sector surrendered some of their recent gains after the $US enjoyed a strong 24-hours.

I can feel investors are becoming increasingly nervous by this fairly aggressive selling, after all it is May, in just 3-sessions the local index has now retreated ~3% wiping out all of Mays gains in the process. Our ideal target area to start accumulating from an index perspective is between 6600 & 6800 but subscribers mustn’t forget that 2021 is all about sector rotation, the below quick comparison of some winners & losers during 2021 illustrates why we shouldn’t be too fixated on the main ASX200 index which has rallied 6%:

Winners: Banks +25%, Insurance +9% & Materials +11%.

Losers: IT Sector -20%, Energy -4% & Transport -4%.

MM is “cashed up” and looking for buying opportunities over the coming months and while we are likely to be patient with some of our buying we won’t be adverse to targeting bargains on the individual stock / sector level if and when they unfold.

Overnight US stocks managed to bounce with the S&P500 gaining +1.2% but after 3 days decline basically wiped out 4-5 weeks gains the behaviour has clearly changed. The financials and resources led the overseas advance which provides a strong read through this morning for the Australian market with the SPI futures calling the ASX to regain most of yesterday losses.