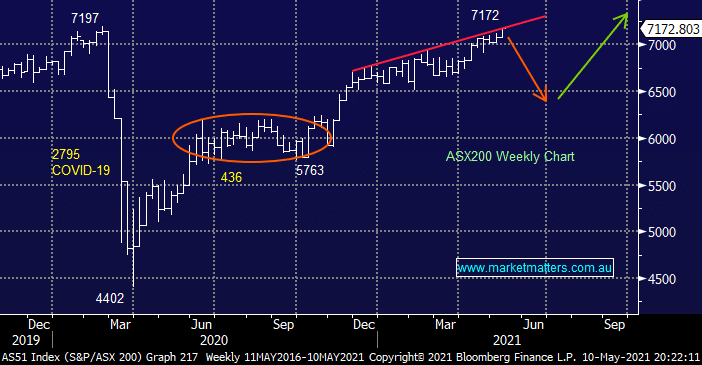

Yesterday saw the ASX200 surge to within touching distance of both its all-time high and the psychological 7200 area but this was not a typical 90-point rally because almost 30% of stocks closed down on the day. Monday was all about Iron Ore and the Resources Sector with around half of the index gain coming from just BHP Group (BHP), RIO Tinto (RIO) and Fortescue Metals Group (FMG) – MM has been bullish the reflation trade through 2021 but as investors you’ve never got enough exposure on days like this! The rest of Asia and New Zealand basically trod water all day but they don’t have our Resources Sector.

In our Macro Monday Report we highlighted BHP in our “Chart of the week” segment, targeting fresh all-time highs in the short-term before we would adopt a more neutral stance but we didn’t anticipate the move to have unfolded before the markets close! The $US nudged lower and the commodities soared higher, it actually felt like they would rally whatever the currencies did and by the time our market closed iron ore was up over +7% and copper almost +3% while even the laggards like crude were positive, what wasn’t to like at 4pm! The panic buying in the sector actually saw FMG outperform Crown (CWN) which received two pieces of improved takeover news taking the casino operator up a mere +7.3% on the day.

However after moves like Monday at MM we like to sit back and reflect on our outlook moving forward and what we’ve already seen to evaluate if it’s time to consider fading the trend. We only have to look at some of the moves so far in 2021 to comprehend that following the herd can lead to average returns. The following names I have listed aren’t chosen to surprise by the size of their moves but more so their individual popularity as the year kicked off because I doubt they would have aligned with many market players picks for 2021, on either side of the ledger:

Winners – Westpac (WBC) +36%, Crown Resorts (CWN) +35%, QBE Insurance (QBE) +25%, BHP Group (BHP) +22% and Telstra (TLS) +18%.

Losers – Challenger Financial (CGF) -25%, Coles (COL) -11%, a2 Milk (A2M) -47%, CSL Ltd (CSL) -3%, Appen (APX) -53% and Afterpay (APT) -17%.

All of these moves in a market which has rallied less than 9% so far in 2021, please excuse us labouring the point that subscribers should remain open-minded at all times but in the coming months / years we believe it’s going to be vital for optimum returns.

Overnight US stocks slipped lower led by the tech space which plunged -2.6%, even the likes of copper and iron ore reversed yesterday’s gains during a classic “risk-off session”, the SPI futures are calling the ASX200 down around 50-points this morning losing over half of yesterday’s gains in the process.