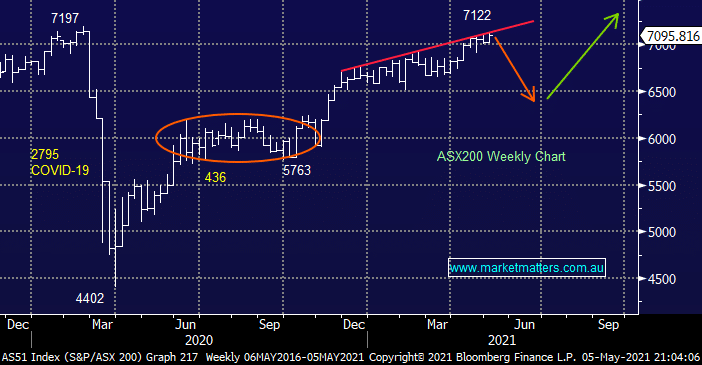

The ASX200 marched ever higher on Wednesday closing less than 1.5% below its all-time high, the heavy lifting was performed by the big 3 of the local index – Commonwealth Bank (CBA), CSL Ltd (CSL) and BHP Group (BHP). Again, gains weren’t broad based with under 50% of the market closing positive but its hard to argue with “higher highs” even if the advance is relatively subdued from a momentum perspective.

ANZ Bank (ANZ) experienced a tough day at the office falling -3.2% on the same day that CBA rallied +2.5%, the issue being ANZ missed analyst expectations by ~3% for the half-year. Following Westpac’s (WBC) strong numbers only a few days ago this appears to have caught a few by surprise with even a bribe like large 70c ff divided not enough to deflect attention away from the miss, this morning NAB delivered their numbers with a few investors probably a touch nervous after yesterday – more on NAB result below. ANZ is the only bank to have fallen over the last month and it still remains our least preferred exposure to the sector.

I mentioned earlier in the week that local mortgages below 2% fixed for 4-years were becoming rarer by the day, in the AFR on Wednesday there was even talk of 3-year terms vanishing later in 2021 causing property buyers to scramble for cheap funding asap. The same could potentially also occur in M&A land, any companies searching for cheap funding to make a takeover more appealing are likely to be “hot to trot”, at MM we are certainly looking to embrace this theme in 2021 where the opportunity arises e.g. Crown Resorts (CWN) and National Storage (NSR) in 2 of the MM Portfolios.

Overnight we again saw stocks finish mixed with the NASDAQ reversing early gains to close down -0.3% while the resources & financials dragged the Dow up +0.3%, the SPI futures are calling the ASX200 marginally higher back above 7100 with BHP Group (BHP) soaring towards $50 set to be a huge bullish influence i.e. fresh 9-week highs.