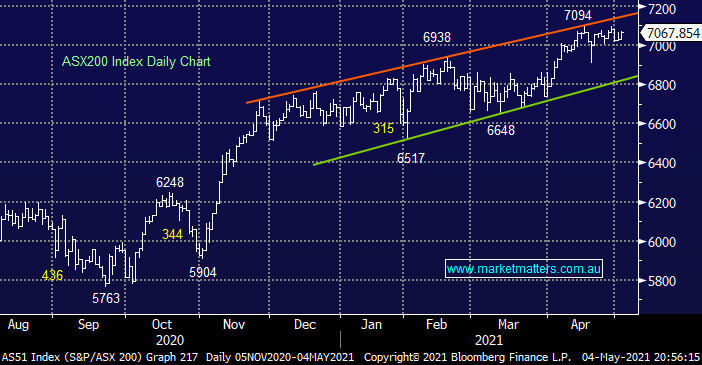

The ASX200 continues to oscillate between 7000 and 7100 as ongoing stock & sector rotation maintains the market equilibrium – yesterday saw only 55% of the index rally but when the resources rally strongly plus CBA / CSL post gains the index is almost guaranteed to be well supported. The Resources Sector continues to embrace any weakness in the $US with BHP Group (BHP), RIO Tinto (RIO) and OZ Minerals (OZL) all popping over +2.5% on Tuesday.

The RBA maintained its almost optimal stock market stance as Phillip Lowe et al continue to adopt an extremely equity friendly stance:

- Both official rates and the RBA target for 3-year bond yields remain at 0.1%.

- While they believe employment and inflation will improve at a faster rate than previously hoped it’ not until 2024 when the RBA believe inflation might jump substantially higher.

- They don’t intend to hike rates until inflation is sustainably between 2 & 3% as they maintain their very accommodative monetary conditions to continue the employment & inflation recovery.

- Globally they believe the economic recovery has become robust aided by the backdrop of positive news on the COVID vaccine.

The combination of government & RBA stimulus as the economy improves still feels almost too good to be true as equities continue to wear their half-full glasses. At MM we are confident rising interest rates will ultimately undo the post GFC bull market but that could still be some years away, it’s all a matter of how well central banks can juggle the balls. However for now we still favour a decent pullback by the ASX, and global stocks, through May / June.

Overseas equities saw major weakness in the tech sector while the Dow still managed to close positive, the SPI Futures are calling the ASX to give back over half of yesterday’s gain with IT stocks likely to be on the nose.